Form Rpd-41372 - Veteran Employment Tax Credit Claim Form

ADVERTISEMENT

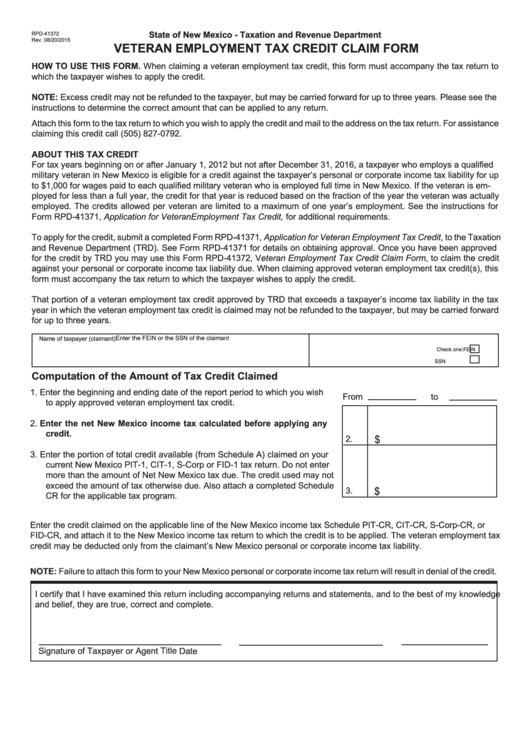

State of New Mexico - Taxation and Revenue Department

RPD-41372

Rev. 08/20/2015

VETERAN EMPLOYMENT TAX CREDIT CLAIM FORM

HOW TO USE THIS FORM. When claiming a veteran employment tax credit, this form must accompany the tax return to

which the taxpayer wishes to apply the credit.

NOTE: Excess credit may not be refunded to the taxpayer, but may be carried forward for up to three years. Please see the

instructions to determine the correct amount that can be applied to any return.

Attach this form to the tax return to which you wish to apply the credit and mail to the address on the tax return. For assistance

claiming this credit call (505) 827-0792.

ABOUT THIS TAX CREDIT

For tax years beginning on or after January 1, 2012 but not after December 31, 2016, a taxpayer who employs a qualified

military veteran in New Mexico is eligible for a credit against the taxpayer’s personal or corporate income tax liability for up

to $1,000 for wages paid to each qualified military veteran who is employed full time in New Mexico. If the veteran is em-

ployed for less than a full year, the credit for that year is reduced based on the fraction of the year the veteran was actually

employed. The credits allowed per veteran are limited to a maximum of one year’s employment. See the instructions for

Form RPD-41371, Application for Veteran Employment Tax Credit, for additional requirements.

To apply for the credit, submit a completed Form RPD-41371, Application for Veteran Employment Tax Credit, to the Taxation

and Revenue Department (TRD). See Form RPD-41371 for details on obtaining approval. Once you have been approved

for the credit by TRD you may use this Form RPD-41372, Veteran Employment Tax Credit Claim Form, to claim the credit

against your personal or corporate income tax liability due. When claiming approved veteran employment tax credit(s), this

form must accompany the tax return to which the taxpayer wishes to apply the credit.

That portion of a veteran employment tax credit approved by TRD that exceeds a taxpayer’s income tax liability in the tax

year in which the veteran employment tax credit is claimed may not be refunded to the taxpayer, but may be carried forward

for up to three years.

Enter the FEIN or the SSN of the claimant

Name of taxpayer (claimant)

Check one:

FEIN

SSN

Computation of the Amount of Tax Credit Claimed

1. Enter the beginning and ending date of the report period to which you wish

From

to

to apply approved veteran employment tax credit.

2. Enter the net New Mexico income tax calculated before applying any

credit.

$

2.

3. Enter the portion of total credit available (from Schedule A) claimed on your

current New Mexico PIT-1, CIT-1, S-Corp or FID-1 tax return. Do not enter

more than the amount of Net New Mexico tax due. The credit used may not

exceed the amount of tax otherwise due. Also attach a completed Schedule

$

3.

CR for the applicable tax program.

Enter the credit claimed on the applicable line of the New Mexico income tax Schedule PIT-CR, CIT-CR, S-Corp-CR, or

FID-CR, and attach it to the New Mexico income tax return to which the credit is to be applied. The veteran employment tax

credit may be deducted only from the claimant’s New Mexico personal or corporate income tax liability.

NOTE: Failure to attach this form to your New Mexico personal or corporate income tax return will result in denial of the credit.

I certify that I have examined this return including accompanying returns and statements, and to the best of my knowledge

and belief, they are true, correct and complete.

Title

Signature of Taxpayer or Agent

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2