An Employer'S Guide To Group Health Continuation Coverage Under Cobra - Employee Benefits Security Administration - U.s. Department Of Labor Page 14

ADVERTISEMENT

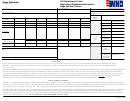

Paying for Continuation Coverage

Group health plans can require qualified beneficiaries to pay for COBRA continuation coverage, although plans can choose

to provide continuation coverage at reduced or no cost. The maximum amount charged to qualified beneficiaries cannot

exceed 102 percent of the cost to the plan for similarly situated individuals covered under the plan who have not incurred a

qualifying event. In calculating premiums for continuation coverage, a plan can include the costs paid by both the employee

and the employer, plus an additional 2 percent for administrative costs. For qualified beneficiaries receiving the 11-month

disability extension of continuation coverage, the premium for those additional months may be increased to 150 percent of

the plan’s total cost of coverage.

COBRA charges to qualified beneficiaries may be increased if the cost to the plan increases but generally must be fixed in

advance of each 12-month premium cycle. The plan must allow qualified beneficiaries to pay the required premiums on a

monthly basis if they ask to do so, and may allow payments at other intervals (for example, weekly or quarterly). All of the

necessary information about COBRA premiums, when they are due, and the consequences of payment and nonpayment

should be described in the COBRA election notice.

Qualified beneficiaries cannot be required to pay a premium at the time they make the COBRA election. Plans must provide

at least 45 days after the election (that is, the date the qualified beneficiary mails the election form if using first-class mail)

for making an initial premium payment. If a qualified beneficiary fails to make any payment before the end of the initial

45-day period, the plan can terminate the qualified beneficiary’s COBRA rights. The plan should establish due dates for any

premiums for subsequent periods of coverage, but it must provide a minimum 30-day grace period for each payment.

Plans are permitted to terminate continuation coverage if full payment is not received before the end of a grace period. If the

amount of a payment made to the plan is incorrect, but is not significantly less than the amount due, the plan must notify the

qualified beneficiary of the deficiency and grant a reasonable period (for this purpose, 30 days is considered reasonable) to

pay the difference. The plan is not obligated to send monthly premium notices, but is required to provide a notice of early

termination if continuation coverage is terminated early due to failure to make a timely payment.

Health Coverage Tax Credit

Certain individuals may be eligible for a Federal income tax credit that can help with qualified monthly premium payments.

The Health Coverage Tax Credit (HCTC), while available, is a refundable tax credit to pay for specified types of health

insurance coverage (including COBRA continuation coverage).

Those potentially eligible for the HCTC include workers who lose their jobs due to the negative effects of global trade

and who are eligible to receive certain benefits under the Trade Adjustment Assistance (TAA) Program, as well as certain

individuals who are receiving pension payments from the Pension Benefit Guaranty Corporation (PBGC). The HCTC pays

72.5 percent of qualified health insurance premiums, with individuals paying 27.5 percent. For more information on TAA,

visit doleta.gov/tradeact/.

Individuals who are eligible for the HCTC may claim the tax credit on their income tax returns at the end of the year.

Qualified family members of eligible TAA recipients or PBGC payees who enroll in Medicare, pass away, or finalize a

divorce, are eligible to receive the HCTC for up to 24 months from the month of the event.

Individuals with questions about the Health Coverage Tax Credit should visit IRS.gov/HCTC.

10

UNITED STATES DEPARTMENT OF LABOR

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Letters

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19