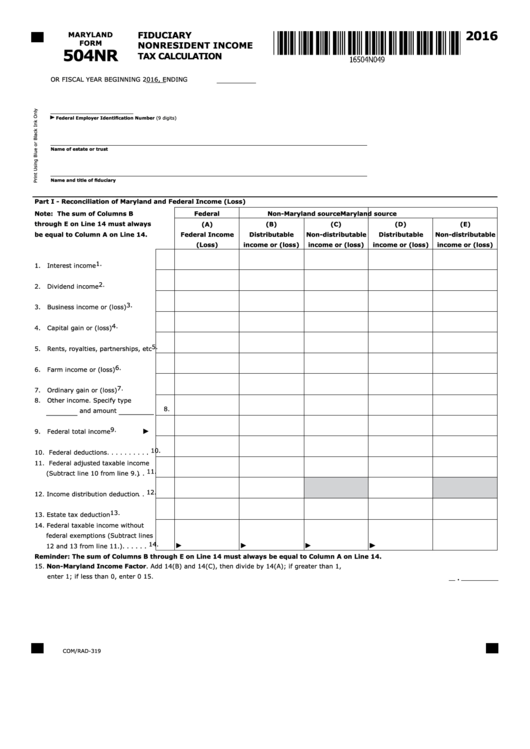

2016

FIDUCIARY

MARYLAND

FORM

NONRESIDENT INCOME

504NR

TAX CALCULATION

OR FISCAL YEAR BEGINNING

2016, ENDING

Federal Employer Identification Number (9 digits)

Name of estate or trust

Name and title of fiduciary

Part I - Reconciliation of Maryland and Federal Income (Loss)

Note: The sum of Columns B

Federal

Non-Maryland source

Maryland source

through E on Line 14 must always

(A)

(B)

(C)

(D)

(E)

be equal to Column A on Line 14.

Federal Income

Distributable

Non-distributable

Distributable

Non-distributable

(Loss)

income or (loss)

income or (loss)

income or (loss)

income or (loss)

1.

1.

Interest income . . . . . . . . . . . .

2.

2.

Dividend income . . . . . . . . . . .

3.

3.

Business income or (loss) . . . . .

4.

4.

Capital gain or (loss) . . . . . . . .

5.

5.

Rents, royalties, partnerships, etc

6.

6.

Farm income or (loss) . . . . . . .

7.

7.

Ordinary gain or (loss) . . . . . . .

8.

Other income. Specify type

8.

________ and amount _________

9.

9.

Federal total income . . . . . . .

10.

10. Federal deductions. . . . . . . . . .

11. Federal adjusted taxable income

11.

(Subtract line 10 from line 9.) . .

12.

12. Income distribution deduction . .

13.

13. Estate tax deduction . . . . . . . .

14. Federal taxable income without

federal exemptions (Subtract lines

14.

12 and 13 from line 11.). . . . . .

Reminder: The sum of Columns B through E on Line 14 must always be equal to Column A on Line 14.

15. Non-Maryland Income Factor. Add 14(B) and 14(C), then divide by 14(A); if greater than 1,

.

enter 1; if less than 0, enter 0 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.

COM/RAD-319

1

1 2

2