Form Au-330 - Controlling Interest Transfer Taxes Page 2

ADVERTISEMENT

Name of Transferor: ______________________________________ Transferor’s CT Tax Registration Number: ____________________ Date of Transfer: ____________

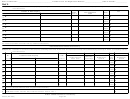

Part V.

Subpart Va.

Interests in Connecticut real property (including farm land, forest land, and open space land) owned directly by the entity in which a controlling interest

was transferred.

Town

Present

Tax

Tax

Location of Real Property

Code

True and Actual

Rate

Town

Street Address

Value

(Table A)

K

K

1a.

K

K

0.0111

K

K

2a.

K

K

0.0111

3a.

K

K

K

K

0.0111

K

4a.

K

K

K

0.0111

K

5a.

K

K

K

0.0111

K

6a.

K

K

K

0.0111

K

7a.

K

K

K

0.0111

8a. Total tax (Include amounts from any attached schedules.)

Attach additional sheets if necessary.

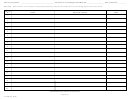

Subpart Vb. Interests in Connecticut real property (including farm land, forest land, and open space land) owned indirectly by the entity in which a controlling interest

was transferred.

Col A

Col C

Col D

Col E

Town

Col B

Owner

Code

Location of Real Property

Applicable

ID

Ownership

Present True and

Multiply Col A

Tax

Multiply Col C

(Table A)

Street Address

Town

Actual Value

Percentage

by Col B

Rate

by Col D

(Part VIII)

K

1b.

K

K

K

0.0111

K

2b.

K

K

K

0.0111

K

3b.

K

K

K

0.0111

K

4b.

K

K

K

0.0111

K

5b.

K

K

K

0.0111

K

6b.

K

K

K

0.0111

K

7b.

K

K

K

0.0111

8b. Total tax (Include amounts from any attached schedules.)

8. Total (Add Line 8a and Line 8b.) Enter here and on Part IV, Line 1.

K

Attach additional sheets if necessary.

AU-330 (Rev. 9/03)

Page 2 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4