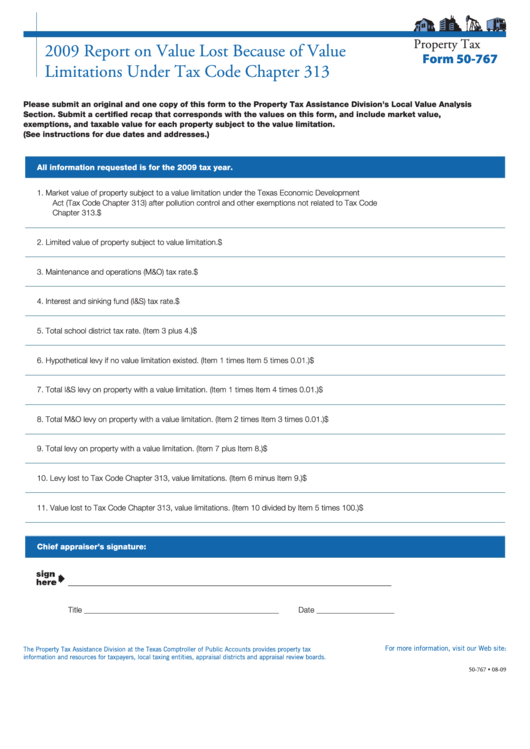

P r o p e r t y T a x

2009 Report on Value Lost Because of Value

Form 50-767

Limitations Under Tax Code Chapter 313

Please submit an original and one copy of this form to the Property Tax Assistance Division’s Local Value Analysis

Section. Submit a certified recap that corresponds with the values on this form, and include market value,

exemptions, and taxable value for each property subject to the value limitation.

(See instructions for due dates and addresses.)

All information requested is for the 2009 tax year.

1.

Market value of property subject to a value limitation under the Texas Economic Development

Act (Tax Code Chapter 313) after pollution control and other exemptions not related to Tax Code

Chapter 313.

$

2.

Limited value of property subject to value limitation.

$

3.

Maintenance and operations (M&O) tax rate.

$

4.

Interest and sinking fund (I&S) tax rate.

$

5.

Total school district tax rate. (Item 3 plus 4.)

$

6.

Hypothetical levy if no value limitation existed. (Item 1 times Item 5 times 0.01.)

$

7.

Total I&S levy on property with a value limitation. (Item 1 times Item 4 times 0.01.)

$

8.

Total M&O levy on property with a value limitation. (Item 2 times Item 3 times 0.01.)

$

9.

Total levy on property with a value limitation. (Item 7 plus Item 8.)

$

10. Levy lost to Tax Code Chapter 313, value limitations. (Item 6 minus Item 9.)

$

11. Value lost to Tax Code Chapter 313, value limitations. (Item 10 divided by Item 5 times 100.)

$

Chief appraiser’s signature:

___________________________________________________________________________________

Title __________________________________________________

Date ____________________

For more information, visit our Web site:

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-767 • 08-09

1

1