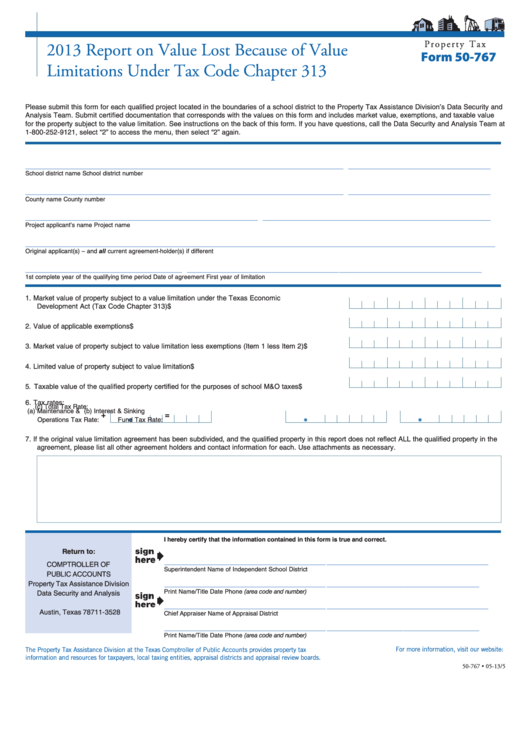

P r o p e r t y T a x

2013 Report on Value Lost Because of Value

Form 50-767

Limitations Under Tax Code Chapter 313

Please submit this form for each qualified project located in the boundaries of a school district to the Property Tax Assistance Division’s Data Security and

Analysis Team. Submit certified documentation that corresponds with the values on this form and includes market value, exemptions, and taxable value

for the property subject to the value limitation. See instructions on the back of this form. If you have questions, call the Data Security and Analysis Team at

1-800-252-9121, select “2” to access the menu, then select “2” again.

___________________________________________________________________

______________________________

School district name

School district number

___________________________________________________________________

______________________________

County name

County number

_________________________________________________

________________________________________________

Project applicant’s name

Project name

___________________________________________________________________________________________________

Original applicant(s) – and all current agreement-holder(s) if different

_________________________________

________________________________

______________________________

1st complete year of the qualifying time period

Date of agreement

First year of limitation

1.

Market value of property subject to a value limitation under the Texas Economic

Development Act (Tax Code Chapter 313). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

2. Value of applicable exemptions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

3. Market value of property subject to value limitation less exemptions (Item 1 less Item 2) . . . . . . . .$

4. Limited value of property subject to value limitation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

5. Taxable value of the qualified property certified for the purposes of school M&O taxes . . . . . . . . . .$

6. Tax rates:

(c) Total Tax Rate:

(a) Maintenance &

(b) Interest & Sinking

+

=

Operations Tax Rate:

Fund Tax Rate:

7.

If the original value limitation agreement has been subdivided, and the qualified property in this report does not reflect ALL the qualified property in the

agreement, please list all other agreement holders and contact information for each. Use attachments as necessary.

I hereby certify that the information contained in this form is true and correct.

Return to:

__________________________________

__________________________________

COMPTROLLER OF

Superintendent

Name of Independent School District

PUBLIC ACCOUNTS

__________________________________

________________

________________

Property Tax Assistance Division

Print Name/Title

Date

Phone (area code and number)

Data Security and Analysis

P.O. Box 13528

__________________________________

__________________________________

Austin, Texas 78711-3528

Chief Appraiser

Name of Appraisal District

__________________________________

________________

________________

Print Name/Title

Date

Phone (area code and number)

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-767 • 05-13/5

1

1 2

2