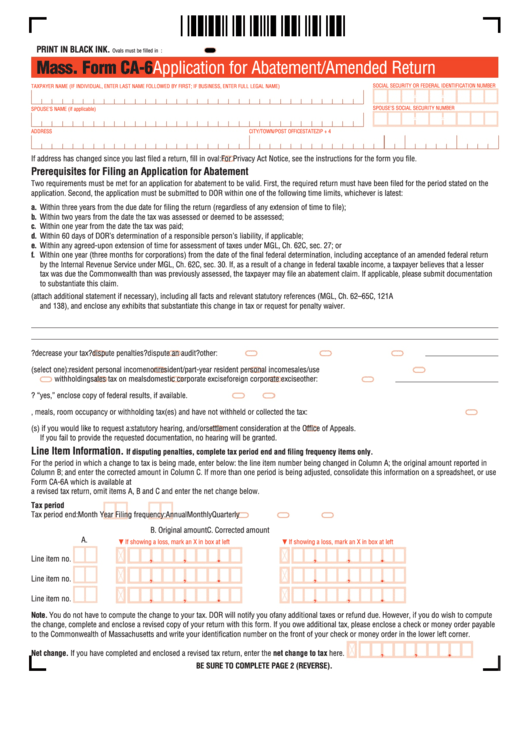

Mass. Form Ca-6 - Application For Abatement/amended Return

ADVERTISEMENT

PRINT IN BLACK INK.

Ovals must be filled in completely. Example:

Mass. Form CA-6

Application for Abatement/Amended Return

SOCIAL SECURITY OR FEDERAL IDENTIFICATION NUMBER

TAXPAYER NAME (IF INDIVIDUAL, ENTER LAST NAME FOLLOWED BY FIRST; IF BUSINESS, ENTER FULL LEGAL NAME)

–

–

SPOUSE’S SOCIAL SECURITY NUMBER

SPOUSE’S NAME (if applicable)

–

–

ADDRESS

CITY/TOWN/POST OFFICE

STATE

ZIP + 4

If address has changed since you last filed a return, fill in oval:

For Privacy Act Notice, see the instructions for the form you file.

Prerequisites for Filing an Application for Abatement

Two requirements must be met for an application for abatement to be valid. First, the required return must have been filed for the period stated on the

application. Second, the application must be submitted to DOR within one of the following time limits, whichever is latest:

a. Within three years from the due date for filing the return (regardless of any extension of time to file);

b. Within two years from the date the tax was assessed or deemed to be assessed;

c. Within one year from the date the tax was paid;

d. Within 60 days of DOR’s determination of a responsible person’s liability, if applicable;

e. Within any agreed-upon extension of time for assessment of taxes under MGL, Ch. 62C, sec. 27; or

f. Within one year (three months for corporations) from the date of the final federal determination, including acceptance of an amended federal return

by the Internal Revenue Service under MGL, Ch. 62C, sec. 30. If, as a result of a change in federal taxable income, a taxpayer believes that a lesser

tax was due the Commonwealth than was previously assessed, the taxpayer may file an abatement claim. If applicable, please submit documentation

to substantiate this claim.

1. Please state the issues involved (attach additional statement if necessary), including all facts and relevant statutory references (MGL, Ch. 62–65C, 121A

and 138), and enclose any exhibits that substantiate this change in tax or request for penalty waiver.

2. Are you filing to

increase your tax?

decrease your tax?

dispute penalties?

dispute an audit?

other:

3. Tax type originally filed (select one):

resident personal income

nonresident/part-year resident personal income

sales/use

withholding

sales tax on meals

domestic corporate excise

foreign corporate excise

other:

4. Are you amending your return as a result of a federal change?

Yes

No. If “yes,” enclose copy of federal results, if available.

5. Fill in oval if you are filing for a reduction in sales, meals, room occupancy or withholding tax(es) and have not withheld or collected the tax:

6. Fill in appropriate oval(s) if you would like to request a:

statutory hearing, and/or

settlement consideration at the Office of Appeals.

If you fail to provide the requested documentation, no hearing will be granted.

Line Item Information.

If disputing penalties, complete tax period end and filing frequency items only.

For the period in which a change to tax is being made, enter below: the line item number being changed in Column A; the original amount reported in

Column B; and enter the corrected amount in Column C. If more than one period is being adjusted, consolidate this information on a spreadsheet, or use

Form CA-6A which is available at Form CA-6A provides space for additional line item information. If you have completed and enclosed

a revised tax return, omit items A, B and C and enter the net change below.

Tax period

Tax period end: Month

Year

Filing frequency:

Annual

Monthly

Quarterly

B. Original amount

C. Corrected amount

A.

M

M

If showing a loss, mark an X in box at left

If showing a loss, mark an X in box at left

,

,

,

,

Line item no.

,

,

,

,

Line item no.

,

,

,

,

Line item no.

Note. You do not have to compute the change to your tax. DOR will notify you of any additional taxes or refund due. However, if you do wish to compute

the change, complete and enclose a revised copy of your return with this form. If you owe additional tax, please enclose a check or money order payable

to the Commonwealth of Massachusetts and write your identification number on the front of your check or money order in the lower left corner.

,

,

Net change. If you have completed and enclosed a revised tax return, enter the net change to tax here.

BE SURE TO COMPLETE PAGE 2 (REVERSE).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2