Mass. Form Ca-6 - Application For Abatement/amended Return Page 2

ADVERTISEMENT

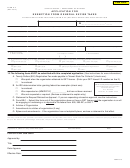

FORM CA-6 PAGE 2

Instructions

Complete this application carefully, as mistakes will cause delays in processing. Please explain why you are requesting an abatement/amendment and at-

tach all pertinent information (Forms W-2 and 1099, schedules, invoices, credit memos, etc.) To determine the appropriate documentation to include, see

DOR’s online Tax Guide at or call the Customer Service Bureau at (617) 887-MDOR or toll-free in Massachusetts 1-800-392-6089. If

you would prefer that DOR discuss this application with someone other than yourself, complete the Power of Attorney section at the bottom of this page.

An abatement may be denied if the information necessary to support the application is not provided.

You do not need to complete this form if you are requesting an adjustment to payments, for example, reporting a payment not properly credited. To resolve

that type of matter, simply call the Customer Service Bureau at (617) 887-MDOR or toll-free in Massachusetts 1-800-392-6089.

Note

Generally, you are not obligated to pay and will not be subject to involuntary collection activities on tax, interest or applicable penalties that you dispute while

your abatement application is under consideration, or while any denial of your abatement claim is on appeal at the Appellate Tax Board or Probate Court.

However, interest and, in some cases, penalties will accrue on any unpaid amount for which you are ultimately held responsible. Please note that the statute

of limitations on collections will generally be suspended during the appeal process. You may wish to pay the amount you are disputing to stop the accrual

of interest and applicable penalties. A refund, with applicable interest, will be issued if the abatement is approved and the assessment has been paid.

Pursuant to MGL, Ch. 62–65C, 121A and 138, the taxpayer named herein makes application for abatement of the tax assessed for the period(s) stated,

to the extent set forth herein. [Consent is hereby given, pursuant to Chapter 58A, Section 6, for the Commissioner of Revenue to act upon this application

after six months from the date of filing.] This consent is provided to protect your rights where processing of your application for abatement is delayed for

any reason. Your consent may be withdrawn at any time. If you do not consent, or withdraw your consent, the application for abatement is deemed denied

(1) at the expiration of six months from the date of filing or (2) the date consent is withdrawn, whichever is later. If you choose not to consent, you must

strike out the sentence in brackets and fill in this oval

.

Sign here.

Under penalties of perjury, I declare that, to the best of my knowledge and belief, the information herein is true, correct and complete.

Taxpayer signature

Title of taxpayer (if applicable)

Daytime phone

Date

Spouse’s signature (if filing jointly)

Date

Preparer’s signature and attestation.

(Fill in oval

) I attest that I prepared this form, and that the statements contained herein, including

information furnished to me by the taxpayer, are true and correct to the best of my knowledge, information and belief.

Preparer’s signature (if representing taxpayer, complete Power of Attorney below)

Preparer’s title

Date

Power of Attorney.

(Fill in oval

) I, the undersigned taxpayer shown on this application, hereby appoint the following individual(s) as attorney(s)-

in-fact to represent the taxpayer(s) before any office of the Massachusetts Department of Revenue for the specified tax period(s).

Name of attorney-in-fact

PTIN

Phone number

Address

City/Town

State

Zip

The attorney(s)-in-fact is authorized, subject to limitations set forth below or to revocation, to receive confidential information and to perform any and all

acts that the taxpayer(s) can perform with respect to the above-specified tax matters. The authority does not include the power to substitute another rep-

resentative (unless specifically added below) or to receive refund checks.

Attorney-in-fact is not authorized to:

Signature of taxpayer

Signature of attorney-in-fact

Before mailing, be sure to:

• sign and date this application;

• enclose a check or money order, if applicable;

• indicate the appropriate tax type in line 3 on the front of this form; and

• attach all pertinent documentation to help us process your claim.

Mail to: Massachusetts Department of Revenue, Customer Service Bureau, PO Box 7031, Boston, MA 02204.

3M 1/04 GP04C30

printed on recycled paper

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2