Instructions For Form Au-298 - Application For A Direct Payment Permit

ADVERTISEMENT

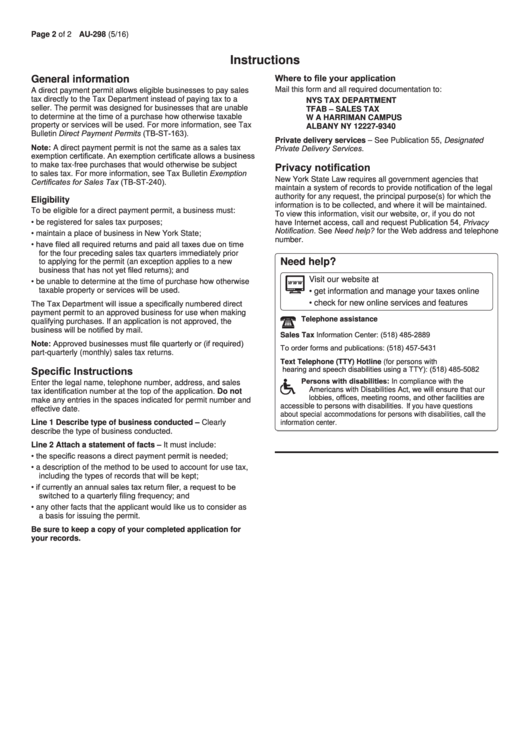

Page 2 of 2 AU-298 (5/16)

Instructions

Where to file your application

General information

Mail this form and all required documentation to:

A direct payment permit allows eligible businesses to pay sales

tax directly to the Tax Department instead of paying tax to a

NYS TAX DEPARTMENT

seller. The permit was designed for businesses that are unable

TFAB – SALES TAX

to determine at the time of a purchase how otherwise taxable

W A HARRIMAN CAMPUS

property or services will be used. For more information, see Tax

ALBANY NY 12227-9340

Bulletin Direct Payment Permits (TB-ST-163).

Private delivery services – See Publication 55, Designated

Note: A direct payment permit is not the same as a sales tax

Private Delivery Services.

exemption certificate. An exemption certificate allows a business

Privacy notification

to make tax-free purchases that would otherwise be subject

to sales tax. For more information, see Tax Bulletin Exemption

New York State Law requires all government agencies that

Certificates for Sales Tax (TB-ST-240).

maintain a system of records to provide notification of the legal

authority for any request, the principal purpose(s) for which the

Eligibility

information is to be collected, and where it will be maintained.

To be eligible for a direct payment permit, a business must:

To view this information, visit our website, or, if you do not

have Internet access, call and request Publication 54, Privacy

• be registered for sales tax purposes;

Notification. See Need help? for the Web address and telephone

• maintain a place of business in New York State;

number.

• have filed all required returns and paid all taxes due on time

for the four preceding sales tax quarters immediately prior

Need help?

to applying for the permit (an exception applies to a new

business that has not yet filed returns); and

Visit our website at

• be unable to determine at the time of purchase how otherwise

taxable property or services will be used.

• get information and manage your taxes online

The Tax Department will issue a specifically numbered direct

• check for new online services and features

payment permit to an approved business for use when making

Telephone assistance

qualifying purchases. If an application is not approved, the

business will be notified by mail.

Sales Tax Information Center:

(518) 485-2889

Note: Approved businesses must file quarterly or (if required)

To order forms and publications:

(518) 457-5431

part-quarterly (monthly) sales tax returns.

Text Telephone (TTY) Hotline (for persons with

Specific Instructions

hearing and speech disabilities using a TTY):

(518) 485-5082

Persons with disabilities: In compliance with the

Enter the legal name, telephone number, address, and sales

tax identification number at the top of the application. Do not

Americans with Disabilities Act, we will ensure that our

lobbies, offices, meeting rooms, and other facilities are

make any entries in the spaces indicated for permit number and

accessible to persons with disabilities. If you have questions

effective date.

about special accommodations for persons with disabilities, call the

Line 1 Describe type of business conducted – Clearly

information center.

describe the type of business conducted.

Line 2 Attach a statement of facts – It must include:

• the specific reasons a direct payment permit is needed;

• a description of the method to be used to account for use tax,

including the types of records that will be kept;

• if currently an annual sales tax return filer, a request to be

switched to a quarterly filing frequency; and

• any other facts that the applicant would like us to consider as

a basis for issuing the permit.

Be sure to keep a copy of your completed application for

your records.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1