Instructions For Form Gro 200 - Gross Receipts Tax Return - Bottlers & Manufacturers Of Soft Drinks

ADVERTISEMENT

INTERNET (8-16)

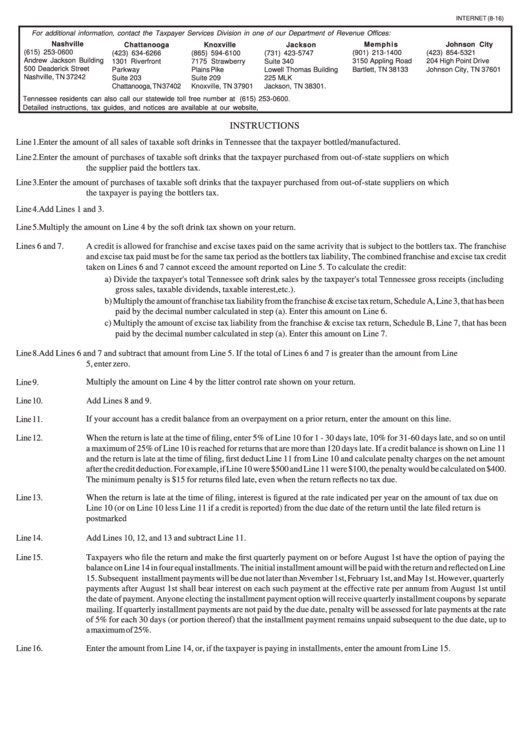

For additional information, contact the Taxpayer Services Division in one of our Department of Revenue Offices:

Nashville

Chattanooga

Knoxville

Jackson

Memphis

Johnson City

(615) 253-0600

(901) 213-1400

(423) 854-5321

(423) 634-6266

(865) 594-6100

(731) 423-5747

Andrew Jackson Building

7175 Strawberry

Suite 340

3150 Appling Road

204 High Point Drive

1301 Riverfront

500 Deaderick Street

Bartlett, TN 38133

Johnson City, TN 37601

Parkway

Plains Pike

Lowell Thomas Building

Nashville, TN 37242

Suite 209

225 MLK Jr.Blvd

Suite 203

Chattanooga, TN 37402

Knoxville, TN 37901

Jackson, TN 38301.

Tennessee residents can also call our statewide toll free number at 1-800-342-1003. Out-of-state callers must dial (615) 253-0600.

Detailed instructions, tax guides, and notices are available at our website,

INSTRUCTIONS

Line 1.

Enter the amount of all sales of taxable soft drinks in Tennessee that the taxpayer bottled/manufactured.

Line 2.

Enter the amount of purchases of taxable soft drinks that the taxpayer purchased from out-of-state suppliers on which

the supplier paid the bottlers tax.

Line 3.

Enter the amount of purchases of taxable soft drinks that the taxpayer purchased from out-of-state suppliers on which

the taxpayer is paying the bottlers tax.

Line 4.

Add Lines 1 and 3.

Line 5.

Multiply the amount on Line 4 by the soft drink tax shown on your return.

Lines 6 and 7.

A credit is allowed for franchise and excise taxes paid on the same acrivity that is subject to the bottlers tax. The franchise

and excise tax paid must be for the same tax period as the bottlers tax liability, The combined franchise and excise tax credit

taken on Lines 6 and 7 cannot exceed the amount reported on Line 5. To calculate the credit:

a) Divide the taxpayer's total Tennessee soft drink sales by the taxpayer's total Tennessee gross receipts (including

gross sales, taxable dividends, taxable interest,etc.).

b) Multiply the amount of franchise tax liability from the franchise & excise tax return, Schedule A, Line 3, that has been

paid by the decimal number calculated in step (a). Enter this amount on Line 6.

c) Multiply the amount of excise tax liability from the franchise & excise tax return, Schedule B, Line 7, that has been

paid by the decimal number calculated in step (a). Enter this amount on Line 7.

Line 8.

Add Lines 6 and 7 and subtract that amount from Line 5. If the total of Lines 6 and 7 is greater than the amount from Line

5, enter zero.

Line 9.

Multiply the amount on Line 4 by the litter control rate shown on your return.

Line 10.

Add Lines 8 and 9.

If your account has a credit balance from an overpayment on a prior return, enter the amount on this line.

Line 11.

Line 12.

When the return is late at the time of filing, enter 5% of Line 10 for 1 - 30 days late, 10% for 31-60 days late, and so on until

a maximum of 25% of Line 10 is reached for returns that are more than 120 days late. If a credit balance is shown on Line 11

and the return is late at the time of filing, first deduct Line 11 from Line 10 and calculate penalty charges on the net amount

after the credit deduction. For example, if Line 10 were $500 and Line 11 were $100, the penalty would be calculated on $400.

The minimum penalty is $15 for returns filed late, even when the return reflects no tax due.

Line 13.

When the return is late at the time of filing, interest is figured at the rate indicated per year on the amount of tax due on

Line 10 (or on Line 10 less Line 11 if a credit is reported) from the due date of the return until the late filed return is

postmarked

Line 14.

Add Lines 10, 12, and 13 and subtract Line 11.

Line 15.

Taxpayers who file the return and make the first quarterly payment on or before August 1st have the option of paying the

balance on Line 14 in four equal installments. The initial installment amount will be paid with the return and reflected on Line

15. Subsequent installment payments will be due not later than November 1st, February 1st, and May 1st. However, quarterly

payments after August 1st shall bear interest on each such payment at the effective rate per annum from August 1st until

the date of payment. Anyone electing the installment payment option will receive quarterly installment coupons by separate

mailing. If quarterly installment payments are not paid by the due date, penalty will be assessed for late payments at the rate

of 5% for each 30 days (or portion thereof) that the installment payment remains unpaid subsequent to the due date, up to

a maximum of 25%.

Line 16.

Enter the amount from Line 14, or, if the taxpayer is paying in installments, enter the amount from Line 15.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2