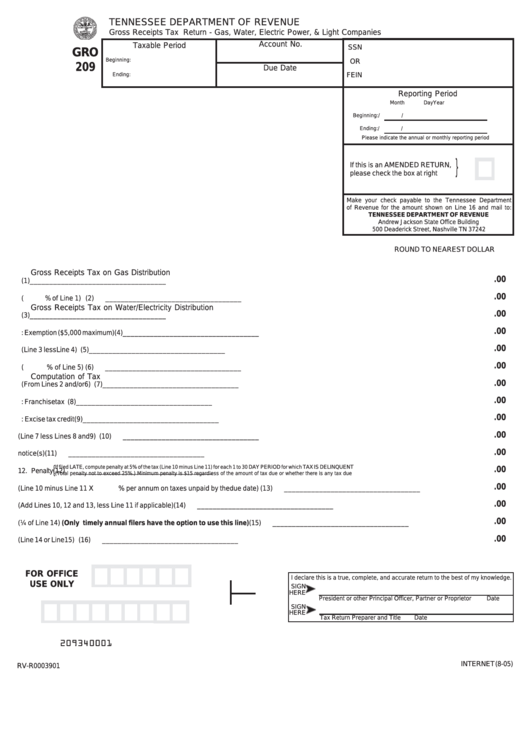

TENNESSEE DEPARTMENT OF REVENUE

Gross Receipts Tax Return - Gas, Water, Electric Power, & Light Companies

Account No.

Taxable Period

SSN

GRO

Beginning:

OR

209

Due Date

Ending:

FEIN

Reporting Period

Month

Day

Year

Beginning:

/

/

Ending:

/

/

Please indicate the annual or monthly reporting period

}

If this is an AMENDED RETURN,

please check the box at right

Make your check payable to the Tennessee Department

of Revenue for the amount shown on Line 16 and mail to:

TENNESSEE DEPARTMENT OF REVENUE

Andrew Jackson State Office Building

500 Deaderick Street, Nashville TN 37242

ROUND TO NEAREST DOLLAR

Gross Receipts Tax on Gas Distribution

.00

1. Gross receipts from gas distribution in Tennessee ............................................................................................. (1)

___________________________________

.00

2. Tax (

% of Line 1) .................................................................................................................................... (2)

___________________________________

Gross Receipts Tax on Water/Electricity Distribution

.00

3. Gross receipts from water/electricity distribution in Tennessee ........................................................................... (3)

___________________________________

.00

4. Less: Exemption ($5,000 maximum) ................................................................................................................... (4)

___________________________________

.00

5. Gross receipts subject to tax (Line 3 less Line 4) ................................................................................................ (5)

___________________________________

.00

6. Tax (

% of Line 5) .................................................................................................................................... (6)

___________________________________

Computation of Tax

.00

7. Gross receipts tax (From Lines 2 and/or 6) ......................................................................................................... (7)

___________________________________

.00

8. Less: Franchise tax credit ................................................................................................................................... (8)

___________________________________

.00

9. Less: Excise tax credit ........................................................................................................................................ (9)

___________________________________

.00

10. Net tax (Line 7 less Lines 8 and 9) .................................................................................................................... (10)

___________________________________

.00

11. Less credit amount from previous Department of Revenue notice(s) ................................................................. (11)

___________________________________

{

If filed LATE, compute penalty at 5% of the tax (Line 10 minus Line 11) for each 1 to 30 DAY PERIOD for which TAX IS DELINQUENT

.00

12. Penalty

(12)

___________________________________

(Total penalty not to exceed 25%.) Minimum penalty is $15 regardless of the amount of tax due or whether there is any tax due

.00

13. Interest (Line 10 minus Line 11 X

% per annum on taxes unpaid by the due date) ................................. (13)

___________________________________

.00

14. Total Tax Due (Add Lines 10, 12 and 13, less Line 11 if applicable) ................................................................. (14)

___________________________________

.00

15. Installment (¼ of Line 14) (Only timely annual filers have the option to use this line) ............................... (15)

___________________________________

.00

16. Total Remittance Amount (Line 14 or Line 15) .................................................................................................. (16)

___________________________________

FOR OFFICE

I declare this is a true, complete, and accurate return to the best of my knowledge.

USE ONLY

SIGN

HERE

President or other Principal Officer, Partner or Proprietor

Date

SIGN

HERE

Tax Return Preparer and Title

Date

209340001

INTERNET (8-05)

RV-R0003901

1

1 2

2