Instructions For Form Gro 200 - Gross Receipts Tax Return - Importers Of Soft Drinks

ADVERTISEMENT

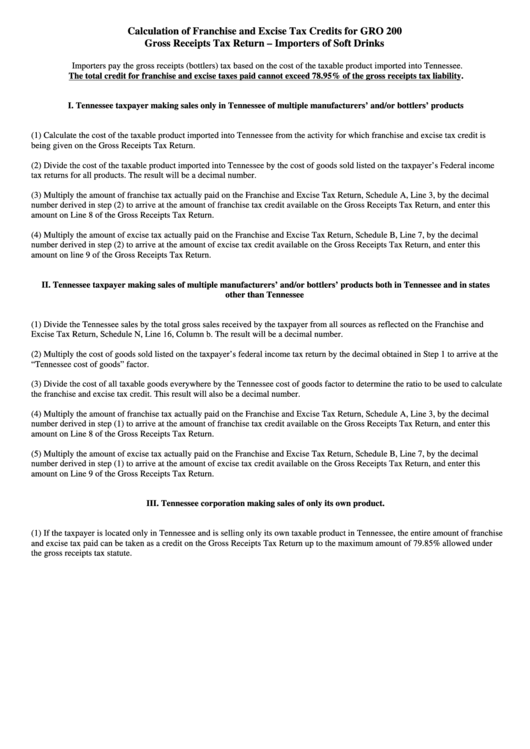

Calculation of Franchise and Excise Tax Credits for GRO 200

Gross Receipts Tax Return – Importers of Soft Drinks

Importers pay the gross receipts (bottlers) tax based on the cost of the taxable product imported into Tennessee.

The total credit for franchise and excise taxes paid cannot exceed 78.95% of the gross receipts tax liability.

I. Tennessee taxpayer making sales only in Tennessee of multiple manufacturers’ and/or bottlers’ products

(1) Calculate the cost of the taxable product imported into Tennessee from the activity for which franchise and excise tax credit is

being given on the Gross Receipts Tax Return.

(2) Divide the cost of the taxable product imported into Tennessee by the cost of goods sold listed on the taxpayer’s Federal income

tax returns for all products. The result will be a decimal number.

(3) Multiply the amount of franchise tax actually paid on the Franchise and Excise Tax Return, Schedule A, Line 3, by the decimal

number derived in step (2) to arrive at the amount of franchise tax credit available on the Gross Receipts Tax Return, and enter this

amount on Line 8 of the Gross Receipts Tax Return.

(4) Multiply the amount of excise tax actually paid on the Franchise and Excise Tax Return, Schedule B, Line 7, by the decimal

number derived in step (2) to arrive at the amount of excise tax credit available on the Gross Receipts Tax Return, and enter this

amount on line 9 of the Gross Receipts Tax Return.

II. Tennessee taxpayer making sales of multiple manufacturers’ and/or bottlers’ products both in Tennessee and in states

other than Tennessee

(1) Divide the Tennessee sales by the total gross sales received by the taxpayer from all sources as reflected on the Franchise and

Excise Tax Return, Schedule N, Line 16, Column b. The result will be a decimal number.

(2) Multiply the cost of goods sold listed on the taxpayer’s federal income tax return by the decimal obtained in Step 1 to arrive at the

“Tennessee cost of goods” factor.

(3) Divide the cost of all taxable goods everywhere by the Tennessee cost of goods factor to determine the ratio to be used to calculate

the franchise and excise tax credit. This result will also be a decimal number.

(4) Multiply the amount of franchise tax actually paid on the Franchise and Excise Tax Return, Schedule A, Line 3, by the decimal

number derived in step (1) to arrive at the amount of franchise tax credit available on the Gross Receipts Tax Return, and enter this

amount on Line 8 of the Gross Receipts Tax Return.

(5) Multiply the amount of excise tax actually paid on the Franchise and Excise Tax Return, Schedule B, Line 7, by the decimal

number derived in step (1) to arrive at the amount of excise tax credit available on the Gross Receipts Tax Return, and enter this

amount on Line 9 of the Gross Receipts Tax Return.

III. Tennessee corporation making sales of only its own product.

(1) If the taxpayer is located only in Tennessee and is selling only its own taxable product in Tennessee, the entire amount of franchise

and excise tax paid can be taken as a credit on the Gross Receipts Tax Return up to the maximum amount of 79.85% allowed under

the gross receipts tax statute.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1