Instructions For Form Gro 212 - Gross Receipts Tax Return - Operators Of Merchandise Vending Machines

ADVERTISEMENT

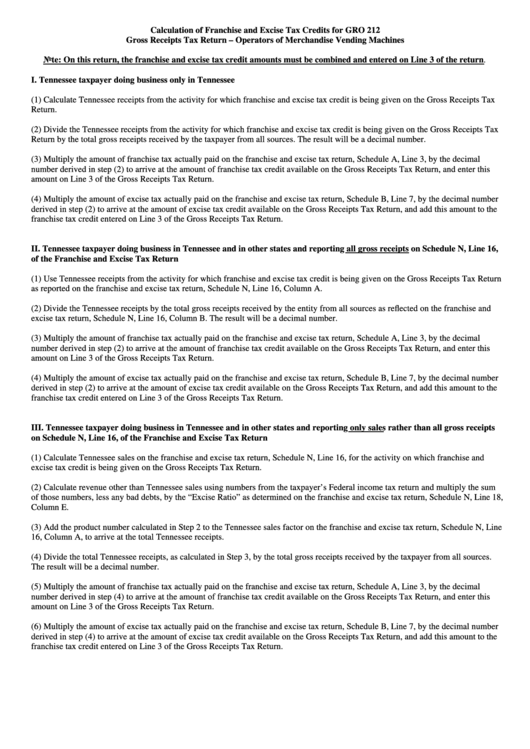

Calculation of Franchise and Excise Tax Credits for GRO 212

Gross Receipts Tax Return – Operators of Merchandise Vending Machines

Note: On this return, the franchise and excise tax credit amounts must be combined and entered on Line 3 of the return.

I. Tennessee taxpayer doing business only in Tennessee

(1) Calculate Tennessee receipts from the activity for which franchise and excise tax credit is being given on the Gross Receipts Tax

Return.

(2) Divide the Tennessee receipts from the activity for which franchise and excise tax credit is being given on the Gross Receipts Tax

Return by the total gross receipts received by the taxpayer from all sources. The result will be a decimal number.

(3) Multiply the amount of franchise tax actually paid on the franchise and excise tax return, Schedule A, Line 3, by the decimal

number derived in step (2) to arrive at the amount of franchise tax credit available on the Gross Receipts Tax Return, and enter this

amount on Line 3 of the Gross Receipts Tax Return.

(4) Multiply the amount of excise tax actually paid on the franchise and excise tax return, Schedule B, Line 7, by the decimal number

derived in step (2) to arrive at the amount of excise tax credit available on the Gross Receipts Tax Return, and add this amount to the

franchise tax credit entered on Line 3 of the Gross Receipts Tax Return.

II. Tennessee taxpayer doing business in Tennessee and in other states and reporting all gross receipts on Schedule N, Line 16,

of the Franchise and Excise Tax Return

(1) Use Tennessee receipts from the activity for which franchise and excise tax credit is being given on the Gross Receipts Tax Return

as reported on the franchise and excise tax return, Schedule N, Line 16, Column A.

(2) Divide the Tennessee receipts by the total gross receipts received by the entity from all sources as reflected on the franchise and

excise tax return, Schedule N, Line 16, Column B. The result will be a decimal number.

(3) Multiply the amount of franchise tax actually paid on the franchise and excise tax return, Schedule A, Line 3, by the decimal

number derived in step (2) to arrive at the amount of franchise tax credit available on the Gross Receipts Tax Return, and enter this

amount on Line 3 of the Gross Receipts Tax Return.

(4) Multiply the amount of excise tax actually paid on the franchise and excise tax return, Schedule B, Line 7, by the decimal number

derived in step (2) to arrive at the amount of excise tax credit available on the Gross Receipts Tax Return, and add this amount to the

franchise tax credit entered on Line 3 of the Gross Receipts Tax Return.

III. Tennessee taxpayer doing business in Tennessee and in other states and reporting only sales rather than all gross receipts

on Schedule N, Line 16, of the Franchise and Excise Tax Return

(1) Calculate Tennessee sales on the franchise and excise tax return, Schedule N, Line 16, for the activity on which franchise and

excise tax credit is being given on the Gross Receipts Tax Return.

(2) Calculate revenue other than Tennessee sales using numbers from the taxpayer’s Federal income tax return and multiply the sum

of those numbers, less any bad debts, by the “Excise Ratio” as determined on the franchise and excise tax return, Schedule N, Line 18,

Column E.

(3) Add the product number calculated in Step 2 to the Tennessee sales factor on the franchise and excise tax return, Schedule N, Line

16, Column A, to arrive at the total Tennessee receipts.

(4) Divide the total Tennessee receipts, as calculated in Step 3, by the total gross receipts received by the taxpayer from all sources.

The result will be a decimal number.

(5) Multiply the amount of franchise tax actually paid on the franchise and excise tax return, Schedule A, Line 3, by the decimal

number derived in step (4) to arrive at the amount of franchise tax credit available on the Gross Receipts Tax Return, and enter this

amount on Line 3 of the Gross Receipts Tax Return.

(6) Multiply the amount of excise tax actually paid on the franchise and excise tax return, Schedule B, Line 7, by the decimal number

derived in step (4) to arrive at the amount of excise tax credit available on the Gross Receipts Tax Return, and add this amount to the

franchise tax credit entered on Line 3 of the Gross Receipts Tax Return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1