Instructions For Form Rev-459b - Consent To Transfer, Adjust Or Correct Pa Estimated Personal Income Tax Account

ADVERTISEMENT

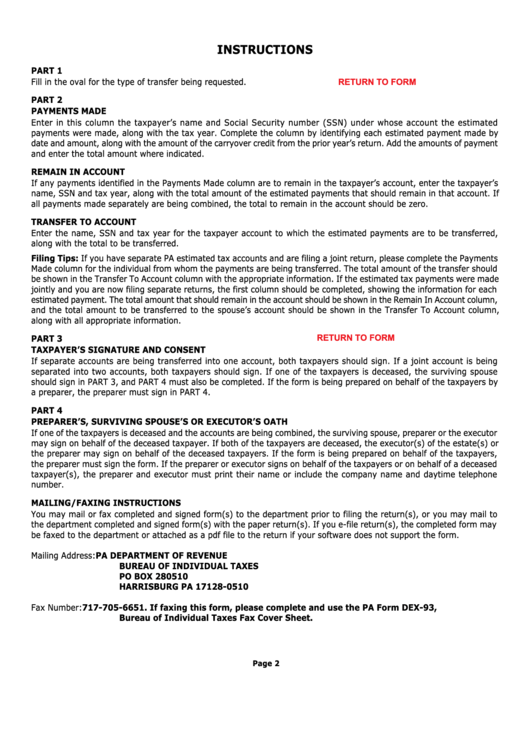

INSTRUCTIONS

PART 1

RETURN TO FORM

Fill in the oval for the type of transfer being requested.

PART 2

PAYMENTS MADE

Enter in this column the taxpayer’s name and Social Security number (SSN) under whose account the estimated

payments were made, along with the tax year. Complete the column by identifying each estimated payment made by

date and amount, along with the amount of the carryover credit from the prior year’s return. Add the amounts of payment

and enter the total amount where indicated.

REMAIN IN ACCOUNT

If any payments identified in the Payments Made column are to remain in the taxpayer’s account, enter the taxpayer’s

name, SSN and tax year, along with the total amount of the estimated payments that should remain in that account. If

all payments made separately are being combined, the total to remain in the account should be zero.

TRANSFER TO ACCOUNT

Enter the name, SSN and tax year for the taxpayer account to which the estimated payments are to be transferred,

along with the total to be transferred.

Filing Tips: If you have separate PA estimated tax accounts and are filing a joint return, please complete the Payments

Made column for the individual from whom the payments are being transferred. The total amount of the transfer should

be shown in the Transfer To Account column with the appropriate information. If the estimated tax payments were made

jointly and you are now filing separate returns, the first column should be completed, showing the information for each

estimated payment. The total amount that should remain in the account should be shown in the Remain In Account column,

and the total amount to be transferred to the spouse’s account should be shown in the Transfer To Account column,

along with all appropriate information.

RETURN TO FORM

PART 3

TAXPAYER’S SIGNATURE AND CONSENT

If separate accounts are being transferred into one account, both taxpayers should sign. If a joint account is being

separated into two accounts, both taxpayers should sign. If one of the taxpayers is deceased, the surviving spouse

should sign in PART 3, and PART 4 must also be completed. If the form is being prepared on behalf of the taxpayers by

a preparer, the preparer must sign in PART 4.

PART 4

PREPARER’S, SURVIVING SPOUSE’S OR EXECUTOR’S OATH

If one of the taxpayers is deceased and the accounts are being combined, the surviving spouse, preparer or the executor

may sign on behalf of the deceased taxpayer. If both of the taxpayers are deceased, the executor(s) of the estate(s) or

the preparer may sign on behalf of the deceased taxpayers. If the form is being prepared on behalf of the taxpayers,

the preparer must sign the form. If the preparer or executor signs on behalf of the taxpayers or on behalf of a deceased

taxpayer(s), the preparer and executor must print their name or include the company name and daytime telephone

number.

MAILING/FAXING INSTRUCTIONS

You may mail or fax completed and signed form(s) to the department prior to filing the return(s), or you may mail to

the department completed and signed form(s) with the paper return(s). If you e-file return(s), the completed form may

be faxed to the department or attached as a pdf file to the return if your software does not support the form.

Mailing Address:

PA DEPARTMENT OF REVENUE

BUREAU OF INDIVIDUAL TAXES

PO BOX 280510

HARRISBURG PA 17128-0510

Fax Number:

717-705-6651. If faxing this form, please complete and use the PA Form DEX-93,

Bureau of Individual Taxes Fax Cover Sheet.

Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1