Form Rev-459b - Consent To Transfer, Adjust Or Correct Pa Estimated Personal Income Tax Account

ADVERTISEMENT

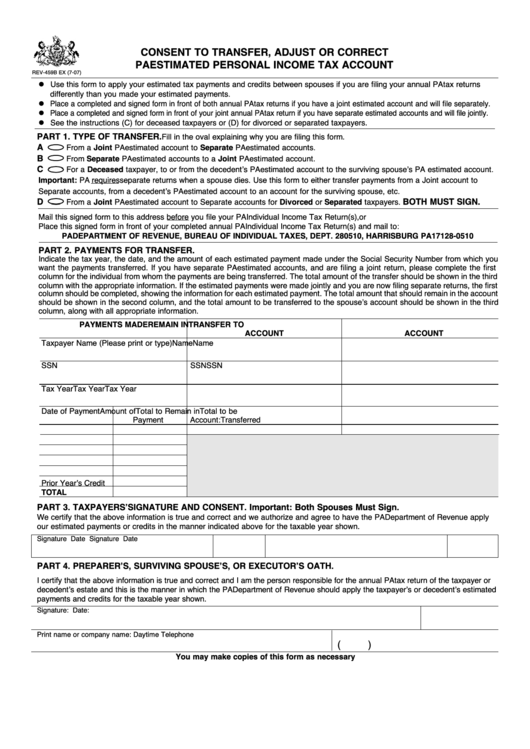

CONSENT TO TRANSFER, ADJUST OR CORRECT

PA ESTIMATED PERSONAL INCOME TAX ACCOUNT

REV-459B EX (7-07)

Use this form to apply your estimated tax payments and credits between spouses if you are filing your annual PA tax returns

differently than you made your estimated payments.

Place a completed and signed form in front of both annual PA tax returns if you have a joint estimated account and will file separately.

Place a completed and signed form in front of your joint annual PA tax return if you have separate estimated accounts and will file jointly.

See the instructions (C) for deceased taxpayers or (D) for divorced or separated taxpayers.

PART 1. TYPE OF TRANSFER.

Fill in the oval explaining why you are filing this form.

A

From a Joint PA estimated account to Separate PA estimated accounts.

B

From Separate PA estimated accounts to a Joint PA estimated account.

C

For a Deceased taxpayer, to or from the decedent’s PA estimated account to the surviving spouse’s PA estimated account.

Important: PA requires separate returns when a spouse dies. Use this form to either transfer payments from a Joint account to

Separate accounts, from a decedent’s PA estimated account to an account for the surviving spouse, etc.

D

BOTH MUST SIGN.

From a Joint PA estimated account to Separate accounts for Divorced or Separated taxpayers.

Mail this signed form to this address before you file your PA Individual Income Tax Return(s),or

Place this signed form in front of your completed annual PA Individual Income Tax Return(s) and mail to:

PA DEPARTMENT OF REVENUE, BUREAU OF INDIVIDUAL TAXES, DEPT. 280510, HARRISBURG PA 17128-0510

PART 2. PAYMENTS FOR TRANSFER.

Indicate the tax year, the date, and the amount of each estimated payment made under the Social Security Number from which you

want the payments transferred. If you have separate PA estimated accounts, and are filing a joint return, please complete the first

column for the individual from whom the payments are being transferred. The total amount of the transfer should be shown in the third

column with the appropriate information. If the estimated payments were made jointly and you are now filing separate returns, the first

column should be completed, showing the information for each estimated payment. The total amount that should remain in the account

should be shown in the second column, and the total amount to be transferred to the spouse’s account should be shown in the third

column, along with all appropriate information.

PAYMENTS MADE

REMAIN IN

TRANSFER TO

ACCOUNT

ACCOUNT

Taxpayer Name (Please print or type)

Name

Name

SSN

SSN

SSN

Tax Year

Tax Year

Tax Year

Date of Payment

Amount of

Total to Remain in

Total to be

Payment

Account:

Transferred

Prior Year’s Credit

TOTAL

PART 3. TAXPAYERS’ SIGNATURE AND CONSENT. Important: Both Spouses Must Sign.

We certify that the above information is true and correct and we authorize and agree to have the PA Department of Revenue apply

our estimated payments or credits in the manner indicated above for the taxable year shown.

Signature

Date

Signature

Date

PART 4. PREPARER’S, SURVIVING SPOUSE’S, OR EXECUTOR’S OATH.

I certify that the above information is true and correct and I am the person responsible for the annual PA tax return of the taxpayer or

decedent’s estate and this is the manner in which the PA Department of Revenue should apply the taxpayer’s or decedent’s estimated

payments and credits for the taxable year shown.

Signature:

Date:

Print name or company name:

Daytime Telephone

(

)

You may make copies of this form as necessary

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1