Form Ct-1120 Sba - Small Business Administration Guaranty Fee Tax Credit - 2012

ADVERTISEMENT

Department of Revenue Services

2012

Form CT-1120 SBA

State of Connecticut

(Rev. 12/12)

Small Business Administration Guaranty Fee Tax Credit

For Income Year Beginning: _______________________ , 2012 and Ending: ________________________ , _________ .

Corporation name

Connecticut Tax Registration Number

Definition

Complete this form in blue or black ink only.

Small business means any business entity qualifying as

Use Form CT-1120 SBA to claim the credit allowed under

a small business under 13 CFR Part 121, which has gross

Conn. Gen. Stat. §12-217cc. Attach it to Form CT-1120K,

receipts of not more than $5 million for the income year in

Business Tax Credit Summary.

which the credit is first allowed.

Credit Computation

Additional Information

A tax credit is allowed against the Connecticut corporation

See Informational Publication 2010(13), Guide to

business tax in an amount equal to the amount paid by a

Connecticut Business Tax Credits, or contact the Department

small business to the federal Small Business Administration,

as a guaranty fee to obtain guaranteed financing.

of Revenue Services, Taxpayer Services Division at

1-800-382-9463 (Connecticut calls outside the Greater

Carryforward/Carryback

Hartford calling area only) or 860-297-5962 (from anywhere).

Any remaining credit balance that exceeds the credit applied

may be carried forward to four succeeding income years.

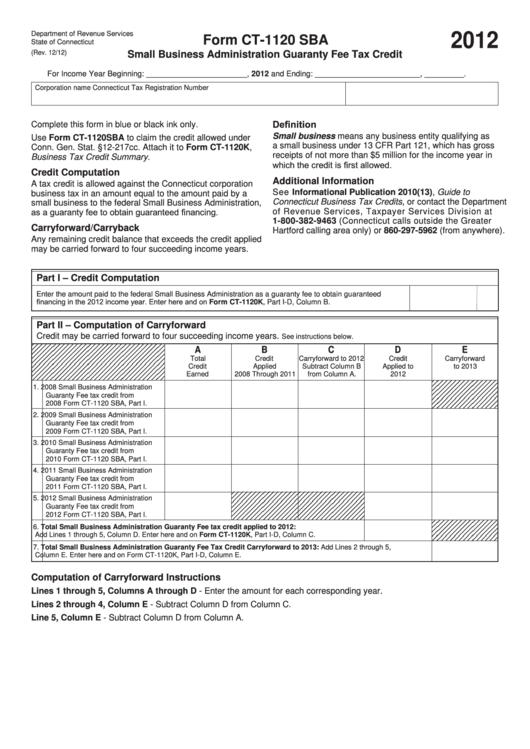

Part I – Credit Computation

Enter the amount paid to the federal Small Business Administration as a guaranty fee to obtain guaranteed

financing in the 2012 income year. Enter here and on Form CT-1120K, Part I-D, Column B.

Part II – Computation of Carryforward

Credit may be carried forward to four succeeding income years.

See instructions below.

A

B

C

D

E

Total

Credit

Carryforward to 2012

Credit

Carryforward

Credit

Applied

Subtract Column B

Applied to

to 2013

Earned

2008 Through 2011

from Column A.

2012

1. 2008 Small Business Administration

Guaranty Fee tax credit from

2008 Form CT-1120 SBA, Part I.

2. 2009 Small Business Administration

Guaranty Fee tax credit from

2009 Form CT-1120 SBA, Part I.

3. 2010 Small Business Administration

Guaranty Fee tax credit from

2010 Form CT-1120 SBA, Part I.

4. 2011 Small Business Administration

Guaranty Fee tax credit from

2011 Form CT-1120 SBA, Part I.

5. 2012 Small Business Administration

Guaranty Fee tax credit from

2012 Form CT-1120 SBA, Part I.

6. Total Small Business Administration Guaranty Fee tax credit applied to 2012:

Add Lines 1 through 5, Column D. Enter here and on Form CT-1120K, Part I-D, Column C.

7. Total Small Business Administration Guaranty Fee Tax Credit Carryforward to 2013: Add Lines 2 through 5,

Column E. Enter here and on Form CT-1120K, Part I-D, Column E.

Computation of Carryforward Instructions

Lines 1 through 5, Columns A through D - Enter the amount for each corresponding year.

Lines 2 through 4, Column E - Subtract Column D from Column C.

Line 5, Column E - Subtract Column D from Column A.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1