Form Ct-633 - Economic Transformation And Facility Redevelopment Program Tax Credit - 2012

ADVERTISEMENT

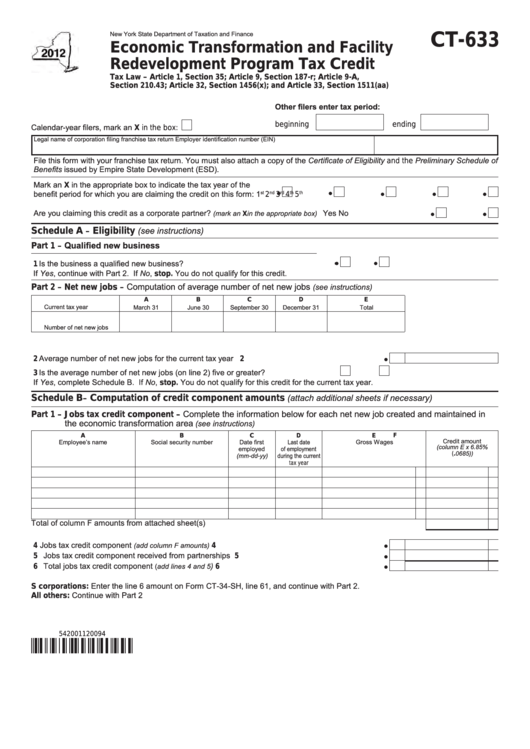

New York State Department of Taxation and Finance

CT-633

Economic Transformation and Facility

Redevelopment Program Tax Credit

Tax Law – Article 1, Section 35; Article 9, Section 187-r; Article 9-A,

Section 210.43; Article 32, Section 1456(x); and Article 33, Section 1511(aa)

Other filers enter tax period:

beginning

ending

Calendar-year filers, mark an X in the box:

Legal name of corporation filing franchise tax return

Employer identification number (EIN)

File this form with your franchise tax return. You must also attach a copy of the Certificate of Eligibility and the Preliminary Schedule of

Benefits issued by Empire State Development (ESD).

Mark an X in the appropriate box to indicate the tax year of the

benefit period for which you are claiming the credit on this form:

1

st

nd

rd

th

th

2

3

4

5

Are you claiming this credit as a corporate partner?

Yes

No

(mark an X in the appropriate box) ................................................

(see instructions)

Schedule A

Eligibility

–

Qualified new business

Part 1

–

1 Is the business a qualified new business? ........................................................... Yes

No

If Yes, continue with Part 2. If No, stop. You do not qualify for this credit.

Computation of average number of net new jobs

(see instructions)

Part 2

Net new jobs

–

–

A

B

C

D

E

Current tax year

March 31

June 30

September 30

December 31

Total

Number of net new jobs

2 Average number of net new jobs for the current tax year ..................................................................

2

3 Is the average number of net new jobs (on line 2) five or greater? ......................... Yes

No

If Yes, complete Schedule B. If No, stop. You do not qualify for this credit for the current tax year.

(attach additional sheets if necessary)

Schedule B

Computation of credit component amounts

–

Complete the information below for each net new job created and maintained in

Part 1

Jobs tax credit component

–

–

the economic transformation area

(see instructions)

A

B

C

D

E

F

Credit amount

Employee’s name

Social security number

Date first

Last date

Gross Wages

(column E x 6.85%

employed

of employment

(.0685))

during the current

(mm-dd-yy)

tax year

Total of column F amounts from attached sheet(s) ....................................................................................................

4 Jobs tax credit component

.............................................................................

(add column F amounts)

4

5 Jobs tax credit component received from partnerships .....................................................................

5

6 Total jobs tax credit component

) .............................................................................

(add lines 4 and 5

6

S corporations: Enter the line 6 amount on Form CT-34-SH, line 61, and continue with Part 2.

All others: Continue with Part 2

542001120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4