Form Boe-392 - Power Of Attorney Page 2

Download a blank fillable Form Boe-392 - Power Of Attorney in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Boe-392 - Power Of Attorney with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

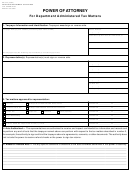

BOE-392 (BACK) REV. 9 (3-11)

To represent the taxpayer for changes to their mailing address for any and all Payroll Tax Law, Benefit Reporting, both

Payroll Tax Law and Benefit Reporting.

�

To execute settlement agreements under section 1236 of the California Unemployment Insurance Code.

�

To delegate authority or to substitute another representative.

�

Other acts (specify):

Franchise Tax Board (FTB) will send you and your first representative listed a copy of FTB computer generated notices as they

become available.

Check this box if you do not want FTB to send copies of available FTB computer generated notices to your first

representative listed.

(Note: Not all FTB processing systems are capable of generating representative copies at this time.)

This Power of Attorney revokes all earlier Power(s) of Attorney on file with the California State Board of Equalization,

the Employment Development Department, or the Franchise Tax Board as identified above for the same matters and years or

periods covered by this form, except for the following: [specify to whom granted, date and address, or refer to attached copies of

earlier power(s)]

NAME

DATE POWER OF ATTORNEY GRANTED

ADDRESS (Number and Street, City, State, ZIP Code)

Unless limited, this Power of Attorney will remain in effect until the final resolution of all tax matters specified herein.

[specify expiration date if limited term]

TIME LIMIT/ExPIRATION DATE (for Board of Equalization and Franchise Tax Board purposes)

Signature of Taxpayer(s)—If a tax matter concerns a joint return, both spouses must sign if joint representation is requested. If you

are a corporate officer, partner, guardian, tax matters partner/person, executor, receiver, registered domestic partner, administrator,

or trustee on behalf of the taxpayer, by signing this Power of Attorney you are certifying that you have the authority to execute this

form on behalf of the taxpayer.

IF THIS POWER OF ATTORNEY IS NOT SIGNED AND DATED BY AN AUTHORIZED INDIVIDUAL, IT WILL BE RETURNED AS INVALID.

SIGNATURE

TITLE (If applicable)

DATE

-

PRINT NAME

TELEPHONE

(

)

SIGNATURE

TITLE (If applicable)

DATE

-

PRINT NAME

TELEPHONE

(

)

Clear

Print

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2