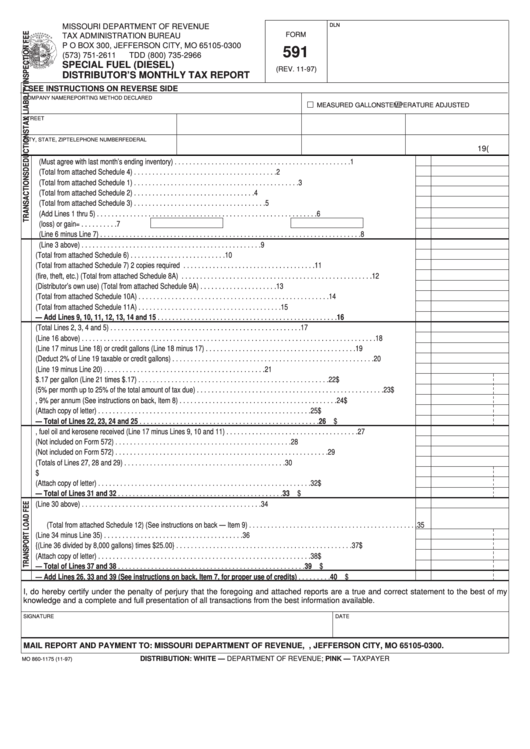

MISSOURI DEPARTMENT OF REVENUE

DLN

FORM

TAX ADMINISTRATION BUREAU

P O BOX 300, JEFFERSON CITY, MO 65105-0300

591

(573) 751-2611

TDD (800) 735-2966

SPECIAL FUEL (DIESEL)

(REV. 11-97)

DISTRIBUTOR’S MONTHLY TAX REPORT

• SEE INSTRUCTIONS ON REVERSE SIDE

COMPANY NAME

REPORTING METHOD DECLARED

MEASURED GALLONS

TEMPERATURE ADJUSTED

STREET ADDRESS

P.O. BOX

LICENSE NUMBER

SALES TAX I.D. NUMBER

CITY, STATE, ZIP

TELEPHONE NUMBER

FEDERAL I.D. NUMBER

MONTH

(

)

19

1. Beginning Inventory (Must agree with last month’s ending inventory) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2. Gallons received from terminals and refineries (Total from attached Schedule 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3. Gallons received from others tax paid (Total from attached Schedule 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4. Gallons received from licensed distributors tax unpaid (Total from attached Schedule 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5. Gallons imported from another State into Missouri (Total from attached Schedule 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6. Total gallons to be accounted for (Add Lines 1 thru 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7. Less distribution during the month

Stock (loss) or gain

= . . . . . . . . . .

7

8. Ending Inventory (Line 6 minus Line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9. Gallons received from licensed distributors tax paid (Line 3 above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10. Tax unpaid deliveries to other licensed special fuel distributors (Total from attached Schedule 6) . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11. Gallons exported from Missouri (Total from attached Schedule 7) 2 copies required . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12. Gallons lost (fire, theft, etc.) (Total from attached Schedule 8A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13. Special fuel used for non-highway purposes (Distributor’s own use) (Total from attached Schedule 9A) . . . . . . . . . . . . . . . . . . . . .

13

14. Sales to U.S. Government (Total from attached Schedule 10A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15. Special fuel sold for non-highway purposes (Total from attached Schedule 11A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

16. TOTAL DEDUCTIONS — Add Lines 9, 10, 11, 12, 13, 14 and 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17. Total gallons of special fuel received (Total Lines 2, 3, 4 and 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

18. Deductions (Line 16 above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19. Taxable gallons (Line 17 minus Line 18) or credit gallons (Line 18 minus 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

20. Allowance (Deduct 2% of Line 19 taxable or credit gallons) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

21. Net taxable gallons or gallons subject to a credit (Line 19 minus Line 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

22. Total amount of tax due at $.17 per gallon (Line 21 times $.17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22 $

23. Penalty (5% per month up to 25% of the total amount of tax due) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23 $

24. Interest for late payment, 9% per annum (See instructions on back, Item 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24 $

25. Credit/Debit from previous report (Attach copy of letter) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25 $

26. TOTAL SPECIAL FUEL TAX — Total of Lines 22, 23, 24 and 25 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26 $

27. Gallons of diesel, fuel oil and kerosene received (Line 17 minus Lines 9, 10 and 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

28. Gallons of K-1 white kerosene received (Not included on Form 572) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

29. Gallons of jet fuel received (Not included on Form 572) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29

30. Total gallons of special fuel subject to fee (Totals of Lines 27, 28 and 29) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30

31. Inspection fee due at 1.7 cents per 50 gallons . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

31 $

32. Credit/Debit from previous report (Attach copy of letter) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

32 $

33. TOTAL INSPECTION FEE AMOUNT DUE — Total of Lines 31 and 32 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33 $

34. Gallons of special fuel subject to transport load fee (Line 30 above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

34

35. Deduct gallons sold to railroad corporations and airlines companies

(Total from attached Schedule 12) (See instructions on back — Item 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

35

36. Total gallons of special fuel subject to transport load fee (Line 34 minus Line 35) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

36

37. Transport load fee {(Line 36 divided by 8,000 gallons) times $25.00} . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

37 $

38. Credit/Debit from previous report (Attach copy of letter) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

38 $

39. TOTAL TRANSPORT LOAD FEE — Total of Lines 37 and 38 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

39 $

40. TOTAL AMOUNT DUE — Add Lines 26, 33 and 39 (See instructions on back, Item 7, for proper use of credits) . . . . . . . . .

40 $

I, do hereby certify under the penalty of perjury that the foregoing and attached reports are a true and correct statement to the best of my

knowledge and a complete and full presentation of all transactions from the best information available.

SIGNATURE

DATE

MAIL REPORT AND PAYMENT TO: MISSOURI DEPARTMENT OF REVENUE, P.O. BOX 300, JEFFERSON CITY, MO 65105-0300.

DISTRIBUTION: WHITE — DEPARTMENT OF REVENUE; PINK — TAXPAYER

MO 860-1175 (11-97)

1

1