Reset Form

Print Form

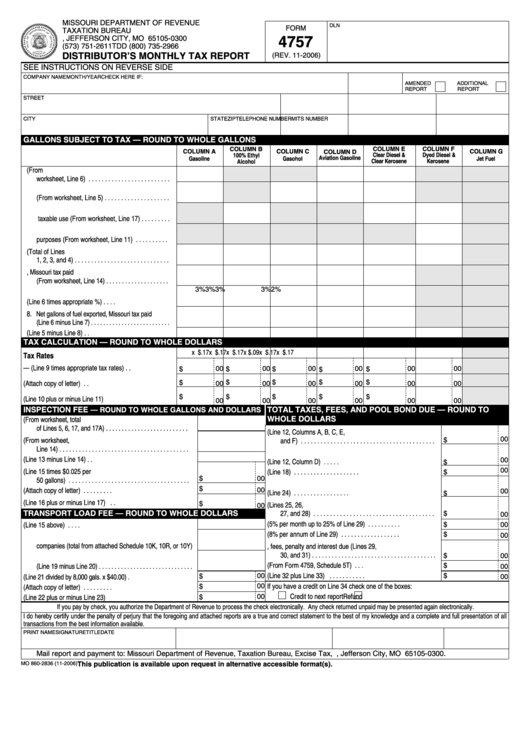

MISSOURI DEPARTMENT OF REVENUE

DLN

FORM

TAXATION BUREAU

P.O. BOX 300, JEFFERSON CITY, MO 65105-0300

4757

(573) 751-2611

TDD (800) 735-2966

DISTRIBUTOR’S MONTHLY TAX REPORT

(REV. 11-2006)

SEE INSTRUCTIONS ON REVERSE SIDE

COMPANY NAME

MONTH/YEAR

CHECK HERE IF:

AMENDED

ADDITIONAL

REPORT

REPORT

STREET ADDRESS

P.O. BOX

LICENSE NUMBER

FEIN

CITY

STATE

ZIP

TELEPHONE NUMBER

MITS NUMBER

GALLONS SUBJECT TO TAX — ROUND TO WHOLE GALLONS

COLUMN B

COLUMN E

COLUMN F

COLUMN A

COLUMN C

COLUMN G

COLUMN D

100% Ethyl

Clear Diesel &

Dyed Diesel &

Aviation Gasoline

Gasoline

Gasohol

Jet Fuel

Alcohol

Clear Kerosene

Kerosene

1. Gallons of blend stock received tax unpaid (From

worksheet, Line 6) . . . . . . . . . . . . . . . . . . . . . . . . .

2. Gallons of fuel received in Missouri tax unpaid

(From worksheet, Line 5) . . . . . . . . . . . . . . . . . . . .

3. Gallons of tax exempt product blended for

taxable use (From worksheet, Line 17) . . . . . . . . .

4. Gallons of dyed fuel sold for taxable

purposes (From worksheet, Line 11) . . . . . . . . . .

5. Gallons subject to tax (Total of Lines

1, 2, 3, and 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Gallons of fuel exported, Missouri tax paid

(From worksheet, Line 14) . . . . . . . . . . . . . . . . . . . .

3%

3%

3%

3%

2%

7. Less allowance (Line 6 times appropriate %) . . . .

8. Net gallons of fuel exported, Missouri tax paid

(Line 6 minus Line 7) . . . . . . . . . . . . . . . . . . . . . . . . . .

9. Net gallons subject to tax (Line 5 minus Line 8) . .

TAX CALCULATION — ROUND TO WHOLE DOLLARS

x $.17

x $.17

x $.17

x $.09

x $.17

x $.17

Tax Rates

10. Tax Due — (Line 9 times appropriate tax rates) . .

00

00

00

00

00

00

$

$

$

$

$

$

$

$

$

$

11. Credit/debit authorization (Attach copy of letter) . .

00

00

00

00

00

00

$

$

$

$

$

12. Total motor fuel tax (Line 10 plus or minus Line 11)

00

00

00

00

00

00

INSPECTION FEE

— ROUND TO WHOLE GALLONS AND DOLLARS

TOTAL TAXES, FEES, AND POOL BOND DUE — ROUND TO

WHOLE DOLLARS

13. Gallons subject to inspection fee (From worksheet, total

of Lines 5, 6, 17, and 17A) . . . . . . . . . . . . . . . . . . . . . . . . . .

25. Total fuel tax due (Line 12, Columns A, B, C, E,

00

$

14. Gallons of fuel exported fees paid (From worksheet,

and F) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Line 14) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15. Gallons subject to inspection fee (Line 13 minus Line 14) . .

00

26. Total aviation gasoline tax due (Line 12, Column D) . . . . .

$

00

16. Inspection fee due (Line 15 times $0.025 per

27. Total inspection fee due (Line 18) . . . . . . . . . . . . . . . . . . . .

$

$

00

50 gallons) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

00

17. Credit/debit authorization (Attach copy of letter) . . . . . . . . .

00

28. Total transport load fee due (Line 24) . . . . . . . . . . . . . . . . .

$

18. Total inspection fee due (Line 16 plus or minus Line 17) . .

$

29. Total taxes and fees due (Lines 25, 26,

00

TRANSPORT LOAD FEE — ROUND TO WHOLE DOLLARS

27, and 28) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

00

30. Penalty (5% per month up to 25% of Line 29) . . . . . . . . . .

$

19. Gallons subject to transport load fee (Line 15 above) . . . .

00

31. Interest (8% per annum of Line 29) . . . . . . . . . . . . . . . . . .

$

00

20. Deduct gallons sold to railroad corporations and airline

companies (total from attached Schedule 10K, 10R, or 10Y)

32. Total taxes, fees, penalty and interest due (Lines 29,

30, and 31) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

00

21. Total gallons subject to transport load fee

33. Pool bond amount due (From Form 4759, Schedule 5T) . . .

$

(Line 19 minus Line 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

34. Total amount remitted (Line 32 plus Line 33) . . . . . . . . . . .

$

22. Transport load fee (Line 21 divided by 8,000 gals. x $40.00) .

$

00

00

If you have a credit on Line 34 check one of the boxes:

$

23. Credit/debit authorization (Attach copy of letter) . . . . . . . . .

00

Credit to next report

Refund

$

24. Total transport load fee due (Line 22 plus or minus Line 23)

If you pay by check, you authorize the Department of Revenue to process the check electronically. Any check returned unpaid may be presented again electronically.

I do hereby certify under the penalty of perjury that the foregoing and attached reports are a true and correct statement to the best of my knowledge and a complete and full presentation of all

transactions from the best information available.

PRINT NAME

SIGNATURE

TITLE

DATE

Mail report and payment to: Missouri Department of Revenue, Taxation Bureau, Excise Tax, P.O. Box 300, Jefferson City, MO 65105-0300.

MO 860-2836 (11-2006)

This publication is available upon request in alternative accessible format(s).

1

1 2

2 3

3 4

4