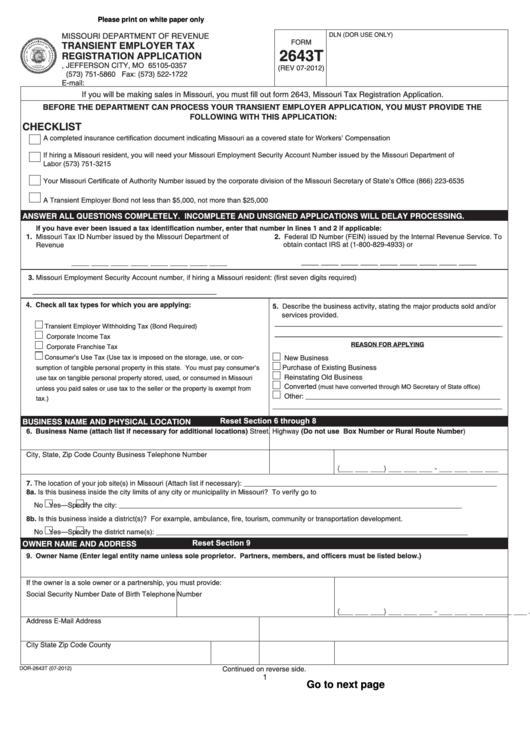

Please print on white paper only

MISSOURI DEPARTMENT OF REVENUE

DLN (DOR USE ONLY)

FORM

TRANSIENT�EMPLOYER�TAX

Reset ALL PAGES of Form

2643T

REGISTRATION�APPLICATION�

P.O. BOX 357, JEFFERSON CITY, MO 65105-0357

Print ALL PAGES of Form

(REV 07-2012)

(573) 751-5860 Fax: (573) 522-1722

E-mail: businesstaxregister@dor.mo.gov

If you will be making sales in Missouri, you must fill out form 2643, Missouri Tax Registration Application.

BEFORE�THE�DEPARTMENT�CAN�PROCESS�YOUR�TRANSIENT�EMPLOYER�APPLICATION,�YOU�MUST�PROVIDE�THE�

FOLLOWING�WITH�THIS�APPLICATION:

CHECKLIST

A completed insurance certification document indicating Missouri as a covered state for Workers’ Compensation

If hiring a Missouri resident, you will need your Missouri Employment Security Account Number issued by the Missouri Department of

Labor (573) 751-3215

Your Missouri Certificate of Authority Number issued by the corporate division of the Missouri Secretary of State’s Office (866) 223-6535

A Transient Employer Bond not less than $5,000, not more than $25,000

ANSWER�ALL�QUESTIONS�COMPLETELY.��INCOMPLETE�AND�UNSIGNED�APPLICATIONS�WILL�DELAY�PROCESSING.

Reset Section 1 through 5

If�you�have�ever�been�issued�a�tax�identification�number,�enter�that�number�in�lines�1�and�2�if�applicable:

1. Missouri Tax ID Number issued by the Missouri Department of

2. Federal ID Number (FEIN) issued by the Internal Revenue Service. To

Revenue

obtain contact IRS at (1-800-829-4933) or�

____ ____ ____ ____ ____ ____ ____ ____ ____

____ ____ ____ ____ ____ ____ ____ ____

� 3 .�Missouri Employment Security Account number, if hiring a Missouri resident: (first seven digits required)

__________________________________________

� 4. Check�all�tax�types�for�which�you�are�applying:

5. Describe the business activity, stating the major products sold and/or

services provided.

___________________________________________________________________

Transient Employer Withholding Tax (Bond Required)

___________________________________________________________________

Corporate Income Tax

REASON�FOR�APPLYING

Corporate Franchise Tax

Consumer’s Use Tax (Use tax is imposed on the storage, use, or con-

New Business

Purchase of Existing Business

sumption of tangible personal property in this state. You must pay consumer’s

Reinstating Old Business

use tax on tangible personal property stored, used, or consumed in Missouri

Converted

(must have converted through MO Secretary of State office)

unless you paid sales or use tax to the seller or the property is exempt from

Other: __________________________________________________

tax.)

___________________________________________________________

________________________________________________________

Reset Section 6 through 8

BUSINESS�NAME�AND�PHYSICAL�LOCATION

6.� Business�Name�(attach�list�if�necessary�for�additional�locations)

Street, Highway (Do�not�use�P.O.�Box�Number�or�Rural�Route�Number)

City, State, Zip Code

County

Business Telephone Number

(___ ___ ___) ___ ___ ___ - ___ ___ ___ ___

7.

The location of your job site(s) in Missouri (Attach list if necessary): _________________________________________________________________

8a.

Is this business inside the city limits of any city or municipality in Missouri? To verify go to https://dors.mo.gov/tax/strgis/index.jsp.

No

Yes—Specify the city: ________________________________________________________________________________________

8b. Is this business inside a district(s)? For example, ambulance, fire, tourism, community or transportation development.

No

Yes—Specify the district name(s): ________________________________________________________________________________

Reset Section 9

OWNER�NAME�AND�ADDRESS

9.� Owner�Name�(Enter�legal�entity�name�unless�sole�proprietor.��Partners,�members,�and�officers�must�be�listed�below.)

If the owner is a sole owner or a partnership, you must provide:

Social Security Number

Date of Birth

Telephone Number

___ ___ ___ - ___ ___ - ___ ___ ___ ___

___ ___ /___ ___ /___ ___ ___ ___

(___ ___ ___) ___ ___ ___ - ___ ___ ___ ___

Address

E-Mail Address

City

State

Zip Code

County

DOR-2643T (07-2012)

Continued on reverse side.

1

Go to next page

1

1 2

2 3

3