Print

Clear

Page 1

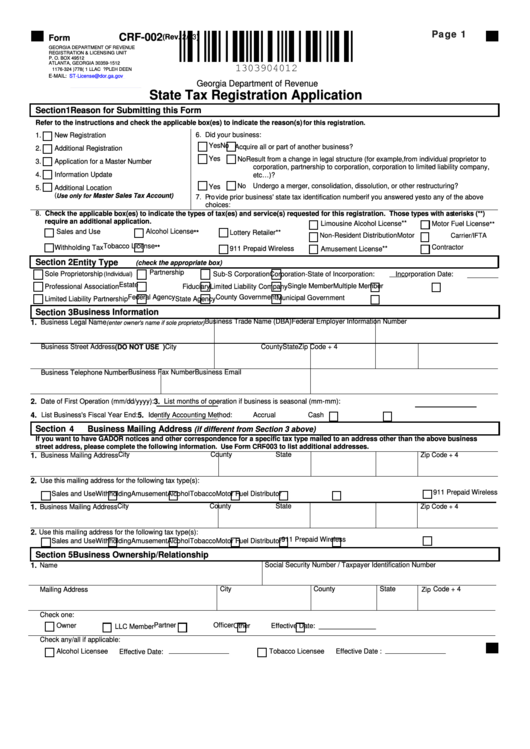

CRF-002

(Rev. 2/13)

Form

GEORGIA DEPARTMENT OF REVENUE

REGISTRATION & LICENSING UNIT

P. O. BOX 49512

ATLANTA, GEORGIA 30359-1512

N

E

E

D

H

E

L

P

?

C

A

L

L

1

8 (

7

) 7

4

2

3

6 -

7

1

1

E-MAIL:

ST-License@dor.ga.gov

Georgia Department of Revenue

TSD-withholding-lic@dor.ga.gov

State Tax Registration Application

Section 1

Reason for Submitting this Form

Refer to the instructions and check the applicable box(es) to indicate the reason(s) for this registration.

1.

New Registration

6. Did your business:

Yes

No Acquire all or part of another business?

2.

Additional Registration

Yes

No Result from a change in legal structure ( for example, from individual proprietor to

3.

Application for a Master Number

corporation, partnership to corporation , corporation to limited liability company,

4.

Information Update

etc…)?

No Undergo a merger, consolidation, dissolution, or other restructuring?

Yes

5.

Additional Location

(

Master Sales Tax Account)

Use only for

7. P ro vide prior business' state tax identification number if you answered yes to any of the above

choices:

8. Check the applicable box(es) to indicate the types of tax(es) and service(s) requested for this registration. Those types with as terisks (**)

require an additional application.

Limousine Alcohol License **

Motor Fuel License **

Sales and Use

Alcohol License **

Lottery Retailer**

Non -Resident Distribution

Motor Carrier/IFTA

Tobacco License **

Withholding Tax

Contractor

911 Prepaid Wireless

Amusement License **

Section 2

Entity Type

(check the appropriate box)

Partnership

Sole Proprietorship

Sub-S Corporation

Corporation- State of Incorporation:

Incorporation Date:

(Individual)

Estate

Single Member

Multiple Member

Professional Association

Fiduciary

Limited Liability Company

Federal Agency

County Government

Municipal Government

Limited Liability Partnership

State Agency

S ection 3

Business Information

Business Trade Name (DBA)

Federal Employer Information Number

1.

Business Legal Name

(enter owner's name if sole proprietor)

County

State

Zip Code + 4

Business Street Address (DO NOT USE P.O. BOX)

City

Business Fax Number

Business Email

Business Telephone Number

2.

Date of First Operation (mm/dd/yyyy):

3.

List months of operation if busine ss is seasonal (mm-mm):

4.

List Business's Fiscal Year End:

5.

Identify Accounting Method:

Accrual

Cash

Section 4

Business Mailing Address

(if different from Section 3 above)

If you want to have GADOR notices and other correspondence for a specific tax type mailed to an address other than the above business

street address, please complete the following information. Use Form CRF -003 to list additional addresses.

City

County

State

Zip Code + 4

1.

Business Mailing Address

2.

Use this mailing address for the following tax type(s):

911 Prepaid Wireless

Sales and Use

Withholding

Amusement

Alcohol

Tobacco

Motor Fuel Distributor

City

County

State

Zip Code + 4

1.

Business Mailing Address

2.

Use this mailing address for the following tax type(s):

911 Prepaid Wireless

Sales and Use

Withholding

Amusement

Alcohol

Tobacco

Motor Fuel Distributor

Section 5

Business Ownership/Relationship

Social Security Number / Taxpayer Identification Number

1.

Name

State

Mailing Address

City

County

Zip Code + 4

Check one:

Partner

Officer

Owner

Other

Effective Date: _______________

LLC Member

Check any/all if applicable:

Alcohol Licensee

Tobacco Licensee

Effective Date :

Effective Date:

1

1 2

2 3

3