Upon withholding from the owner’s share, the disregarded

Line 8 – Montana Individual Tax Withheld. If the owner is

entity is required to complete Form PT-WH notifying the

a nonresident individual who did not sign an agreement to

owner of the amount of withholding remitted to the State of

fi le a Montana tax return, the disregarded entity is required

Montana. The owner may use this amount as a payment

to withhold tax at the rate of 6.9% on that individual’s

against their corporate license tax or individual income tax.

Montana source income. Enter the amounts withheld for

each owner and reported on Schedule I, Column F.

What happens if I am late in fi ling Form DER-1?

Line 10 – Total Payment Due. Add lines 6 and 9. This is

A disregarded entity is charged a late fi le penalty if Form

the total amount that you should remit with your information

DER-1 is fi led after the due date, including the automatic

return. To assure proper application of your payment,

extension, unless the entity can show reasonable cause

include your FEIN or SSN and “FORM DER-1” in the memo

for not fi ling on time. For a disregarded entity that does

section of the payment. Send your payment and Form

not have a tax year, the penalty is based on the number of

DER-1 to: Montana Department of Revenue, PO Box 8021,

owners on December 31 of the preceding year. This penalty

Helena, MT 59604-8021.

is calculated for up to fi ve months. For more information,

see “Late Filing Penalty” below.

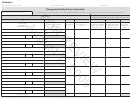

Schedule I Instructions

Please Note: A late fi le penalty is not imposed on an entity

Except for an IRC § 761 partnership, the disregarded

that has ten or fewer owners if the owners have fi led the

entity should have only one owner who owns 100% of the

required tax returns or other required reports timely and

disregarded entity.

have paid all taxes when due.

Column A – Name and Address of Owner. Enter the

name and complete mailing address of each owner. Include

Form DER-1 Instructions

the street address, city, state and zip code.

Heading. Enter the name and address of the disregarded

Column B – Identifi cation Number. If the owner is an

entity that is doing business in Montana.

individual, enter the social security number (SSN). If the

Federal Employer Identifi cation Number (FEIN) or

owner is an individual fi ling federal Schedule C, enter the

Social Security Number (SSN). Enter the FEIN or SSN of

individual’s SSN.

the disregarded entity. If the FEIN or SSN is the same as

If the owner is a C corporation, enter the federal

the owner’s FEIN or SSN reported on Schedule I, check

identifi cation number (FEIN). If the owner is a single

the box located below.

member limited liability company owned by an S

Lines 1 through 4 – Complete lines 1 through 4 as they

corporation, enter the S corporation’s FEIN.

relate to the disregarded entity and not the owner of the

Column C - Percentage of Ownership. Enter each

disregarded entity.

owner’s percentage of ownership. Generally, this is 100%

Line 5 – Disregarded Entity Type. Check only one of the

unless the disregarded entity is an IRC § 761 partnership.

fi ve types of disregarded entities listed.

Column D – Montana Source Income. Enter the owner’s

If you have checked the box indicating that you are a single

share of the disregarded entity’s Montana source income,

member limited liability company, check the appropriate

gain, loss, deduction or credit.

box that corresponds with the 10 types of owners listed

Column E – Montana Corporation Tax Withheld. If the

under the single member limited liability company category.

owner is a foreign C corporation, multiply the amount in

If you have checked the box indicating that you are an

column D by 6.75% and enter the result in this column.

IRC § 761 partnership or an IRC § 1361(b)(3) qualifi ed

Column F – Montana Individual Tax Withheld. If the

subchapter S subsidiary, enter the date of your federal

owner is a nonresident individual or a second tier pass-

election.

through entity, multiply the amount in column D by 6.9%

Line 6 – Late File Penalty. A disregarded entity is charged

and enter the result in this column.

a late fi le penalty if Form DER-1 is fi led after the due date,

Column G – Consent Agreement or Statement. The

including the automatic extension, unless the entity can

information supplied in this column is for nonresident

show reasonable cause for not fi ling on time. The penalty

owners who will be fi ling a Montana tax return. An owner

is $10 multiplied by the number of owners at the close of

is considered a nonresident if the individual owner is not a

the tax year for each month or fraction of a month that

Montana resident. A disregarded entity is not required to

the entity does not fi le the disregarded entity information

complete and attach a new agreement each year as long

return. This penalty is calculated for up to fi ve months. For

as we have an up-to-date Form PT-AGR for that owner.

example, if a disregarded entity owned by ten individuals

and an S corporation fi les the Form DER-1 six months after

You only need to provide Form PT-STM for a second tier

its due date, the late fi le penalty would be $550 ($10 x 11 x

pass-through entity that has a nonresident owner. If the

5 months).

owner is a second tier pass-through entity, we have to

receive a new Form PT-STM each year. In column G, enter

Line 7 – Montana Corporation Tax Withheld. If the owner

the year that the form was provided to us or attach copies

is a foreign C corporation and did not sign an agreement to

of up-to-date, signed agreements and statements and enter

fi le a Montana tax return, the disregarded entity is required

“2009” in column G.

to withhold tax at the rate of 6.75% on the corporation’s

Montana source income. Enter the amounts withheld for

each owner and reported on Schedule I, Column E.

1

1 2

2 3

3 4

4