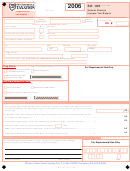

Form Sd-100 - School District Income Tax Return - 2001 Page 2

ADVERTISEMENT

2001 SCHOOL DISTRICT INCOME TAX INSTRUCTIONS

If during 2001 you resided in or had school district income tax withheld for more than one of the school districts listed

in the back of the SD-100 booklet, you must complete separate returns for those school districts affected.

Line 1

Ohio adjusted gross income—

Line 8

School district tax less credit—subtract line 7 from line

‰

If you filed your Ohio income tax return using a paper

6 and enter the result on line 8.

return, enter the amount from line 3 of your Ohio Form

IT-1040 or IT-1040EZ.

Line 9

School district income tax withheld—enter only the

‰

If you filed your Ohio income tax return by telephone

that is clearly identified

SCHOOL DISTRICT WITHHOLDING TAX

and filed your federal taxes using either federal Form

on your W-2’s with the school district number for the

1040A, 1040EZ or by telephone, enter the amount

school district for which you are filing this return. At-

from line 3 of your Ohio TeleFile worksheet.

tach a copy of your W-2’s to the back of your return.

‰

If you filed your Ohio income tax return by telephone

and filed your federal taxes using the federal long Form

Line 10 Estimated payments/credit carryover—if you made es-

1040, enter amount from line 3 of your Ohio TeleFile

timated school district income tax payments and/or an

worksheet less any amount on line 4 of the Ohio Tele-

SD-40P extension payment, enter the total amount on

File worksheet.

line 10. Also include any credit carryover from your

2000 SD-100 return.

Line 2

Part-year or nonresident deduction—enter the amount

of income included on line 1 that was earned while not

Line 11 Total payments—add line 9 and line 10 and enter the

a resident of the school district for which you are filing

total on line 11.

this return.

Line 12

AMOUNT YOU

OWE—if line 11 is less than line 8,

Line 3

School district adjusted gross income—subtract line 2

subtract line 11 from line 8 and enter your balance due

from line 1 and enter the result on line 3.

amount on line 12.

Make your check or money order

payable to

, and write your

SCHOOL DISTRICT INCOME TAX

Line 4

Exemptions—enter the number of personal and depen-

social security number, school district number, and “2001

dent exemptions that you reported on your 2001 IT-

SD-100” on your check or money order.

1040, IT-1040EZ or Ohio TeleFile return in the space

provided on line 4 and multiply this number by $1,150.

Line 13 Overpayment—if line 11 is more than line 8, subtract

line 8 from line 11 and enter the result on line 13. You

Line 5

School district taxable income—subtract line 4 from line

must also complete line 14 and/or line 15.

3 and enter the result on line 5.

Line 14 CREDIT TO 2002—indicate the amount of line 13 you

Line 6

School district tax—multiply line 5 (school district tax-

want us to credit to your 2002 school district liability.

able income) by the appropriate tax rate for your dis-

You cannot apply a credit against a balance due for

trict shown in the SD-100 booklet, and enter the result

another school district, another person’s tax, prior

on line 6.

year’s tax, or your Ohio income tax return.

Line 7

Senior citizen credit—you may claim a $50 credit if you

Line 15 REFUND—subtract line 14 from line 13. This is the

were 65 years of age or older prior to January 1, 2002.

amount of line 13 you want us to refund to you.

You

Only one credit of $50 is allowed for each return even if

cannot apply a refund against a balance due for an-

you are filing a joint return and you and your spouse

other school district, another person’s tax, prior

are both 65 years of age or older.

year’s tax, or your Ohio income tax return.

2001 School District Residency Status:

1. Resident of school district: Check box #1 on the front if you were a full-year resident of the school district for which you

are filing this return.

2. Part-year resident of school district (from ___ / ___ / 2001 to ___ / ___ / 2001): Check box #2 on the front of this return.

If you were not a full-year resident of the school district for which you are filing this return, explain your part-year

status below. Your explanation may help avoid a delay in processing your return.

3. Nonresident of school district: Check box #3 on the front of this return. If you were not at any time in 2001 a resident

of the school district for which you are filing this return, explain your nonresident status below and identify your

resident school district. Your explanation may help avoid a delay in processing your return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2