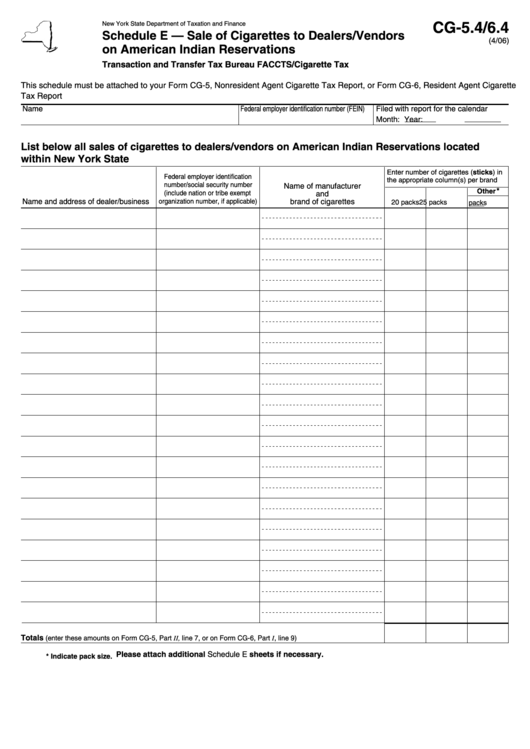

Form Cg-5.4/6.4 Schedule E - Sale Of Cigarettes To Dealers/vendors On American Indian Reservations

ADVERTISEMENT

CG-5.4/6.4

New York State Department of Taxation and Finance

Schedule E — Sale of Cigarettes to Dealers/Vendors

(4/06)

on American Indian Reservations

Transaction and Transfer Tax Bureau FACCTS/Cigarette Tax

This schedule must be attached to your Form CG-5, Nonresident Agent Cigarette Tax Report, or Form CG-6, Resident Agent Cigarette

Tax Report

Name

Federal employer identification number (FEIN)

Filed with report for the calendar

Month:

Year:

List below all sales of cigarettes to dealers/vendors on American Indian Reservations located

within New York State

Enter number of cigarettes (sticks) in

Federal employer identification

the appropriate column(s) per brand

number/social security number

Name of manufacturer

*

Other

(include nation or tribe exempt

and

Name and address of dealer/business

brand of cigarettes

organization number, if applicable)

20 packs

25 packs

packs

Totals

.......................................

(enter these amounts on Form CG-5, Part II, line 7, or on Form CG-6, Part I, line 9)

Please attach additional Schedule E sheets if necessary.

* Indicate pack size.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2