Instructions For Form Rv-2 - Periodic Rental Motor Vehicle And Tour Vehicle Surcharge Tax Return - 2003 Page 2

ADVERTISEMENT

Follow the example presented in italics for a sample of how to fill out the form. The circled numbers on the sample form

correspond to the steps in the instructions.

Example: A taxpayer, BTK Rentals and Tour Vehicles (BTK), with registration no. 10009876, files its January return. BTK

has twenty rental cars, two tour vehicles (8-25 passenger), and one tour vehicle (40 passenger) on Oahu. BTK also has ten

rental cars on Maui. The twenty cars on Oahu were rented for 550 rental days of which 25 rental days were to lessees whose

vehicles were being repaired. The cars on Oahu were, therefore, rented for a total of 525 net rental days. The ten cars on

Maui were rented for a total of 270 rental days. Both of the vans and the tour bus were in service for the month of January.

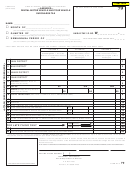

THE TOP OF THE TAX RETURN (fig. 2.0)

STEP 1 - If a name is not already printed on the form, write in your name (taxpayer’s name) in the area provided.

STEP 2 - If a rental vehicle registration number is printed on the form, make sure it is correct. If the preprinted number is

incorrect, write in the correct number. If it is not printed on the form, write it in the area provided.

STEP 3 - If the form is not preprinted with the filing period, place an “X” in the appropriate box to indicate the filing period

(Month, Quarter, or Semiannual Period) for which the tax return is being filed. Write in the month, quarter, or semiannual

period and year covered by the return.

BTK files monthly returns, so an “X” was placed in the box labeled “MONTH OF” and BTK wrote “January 2003”

following the “MONTH OF.”

FORM RV-2

STATE OF HAWAII — DEPARTMENT OF TAXATION

DO NOT WRITE IN THIS AREA

70

(REV. 2002)

RENTAL MOTOR VEHICLE AND TOUR VEHICLE

SURCHARGE TAX

Use this form for periods beginning after August 31, 1999

1

BTK Rentals and Tour Vehicles

NAME:

3

January 2004

MONTH OF

X

(Do not combine your filing for more than one month, if filing monthly.)

2

QUARTER OF

R.V. I.D. NO. __ __ __ __ __ __ __ __

1 0 0 0 9 8 7 6

(Do not combine your filing for more than one quarter, if filing quarterly.)

SEMIANNUAL PERIOD OF

fig. 2.0

COMPUTING THE TAXES

fig. 2.1)

(

STEP 4 - Column A, Lines 1 through 4. Enter the number of days that your rental motor vehicles were rented during the

period. If filing quarterly or semiannually, add the Rental Motor Vehicle days for each month during the period, and enter the

totals on the appropriate lines.

For example, if you have five cars on Oahu and they were each rented for thirty days during the period, enter “150” (5 x 30)

in Column A, Line 1.

All activities must be allocated to their proper district(s). If you enter an amount on the “Totals” line (line 5) of any column,

you must enter amount(s) which equal that total on the district allocation lines (line 1 through 4) of that column, or we will not

be able to correctly process your tax return.

For Column A, Line 1 (Rental Motor Vehicle days on Oahu), BTK has entered the net rental days of “525.” For Column A,

Line 2, (Rental Motor Vehicle days on Maui) BTK has entered the net rental days of “270.”

STEP 5 - Column B, Lines 1 though 4. Enter the number of tour vehicles (8-25 passengers) used during the period for each

District. If filing quarterly or semiannually, multiply the number of tour vehicles by the number of months in the period.

In Column B, Line 1, BTK has entered “2” for the number of tour vehicles for Oahu.

STEP 6 - Column C, lines 1 through 4. Enter the number of tour vehicles (26 or more passengers) used during the period for

each district. If filing quarterly or semiannually, multiply the number of tour vehicles by the number of months in the period.

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4