Instructions For Form Rv-2 - Periodic Rental Motor Vehicle And Tour Vehicle Surcharge Tax Return - 2003 Page 3

ADVERTISEMENT

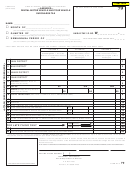

In Column C, Line 1, BTK has entered “1” for the number of tour vehicles for Oahu.

STEP 7a. - Add the number of Rental Motor Vehicle Days from Column A for all districts (Lines 1 through 4).

In Column A, Line 5, BTK has entered 795 rental vehicle days for the month of January.

STEP 7b. - Add the number of tour vehicles from Column B for all districts (Lines 1 through 4).

In Column B, Line 5, BTK has entered 2 tour vehicles for the month of January.

STEP 7c. - Add the number of tour vehicles from Column C for all districts (Lines 1 through 4).

In Column C, Line 5, BTK has entered 1 tour vehicle for the month of January.

STEP 8a - In Column A, multiply the number entered on Line 5 by the tax rate of $3 (Line 6), and enter the result on Line 7.

BTK has multiplied 795 (the number of vehicle days entered on Line 5) by $3 (the tax rate listed on Line 6) to get $2,385,

which is entered in Column A, Line 7 (795 x $3 = $2,385).

STEP 8b - In Column B, multiply the number entered on Line 5 by the tax rate of $15 (Line 6) and enter the result on

Column B, Line 7.

BTK has multiplied 2 (the number of tour vehicles in use during the month on Line 5) by $15 (the tax rate listed on Line 6)

to get $30, which is entered in Column B, Line 7 (2 x $15 = $30).

STEP 8c - In Column C, multiply the number entered on Line 5 by the tax rate of $65 (Line 6), and enter the result on Line 7.

BTK has multiplied 1 (the number of tour vehicles in use during the month on Line 5) by $65 (the tax rate on Line 6) to get

$65, which is entered in Column C, Line 7 (1 x $65 = $65).

COLUMN A

COLUMN B

COLUMN C

Rental Motor Vehicle

Tour Vehicle Surcharge Tax —

Tour Vehicle Surcharge Tax —

4

5

6

Surcharge Tax — Enter the

Enter the Number of Tour

Enter the Number of Tour

Number of Rental Motor Vehicle

Vehicles Carrying 8 - 25

Vehicles Carrying 26 or More

Days

Passengers

Passengers

1 OAHU DISTRICT

1

525

2

1

2 MAUI DISTRICT

2

270

3 HAWAII DISTRICT

3

4 KAUAI DISTRICT

4

5 TOTALS

7a

(Add lines 1 thru 4 of

7b

7c

5

795

2

1

columns A, B, and C)

$3

$15

$65

6 RATES

6

7 TAXES

(Multiply line 5 by line 6 of

8c

8a

8b

2,385

00

30

00

65

00

7

columns A, B, and C)

TOTAL TAXES DUE (Add line 7,

IF YOU DO NOT HAVE ANY ACTIVITY, AND THE RESULT IS NO TAX LIABILITY, ENTER

8

9

2

80 00

fig. 2.1

FINISHING THE TAX RETURN (fig. 2.2)

STEP 9 - Add Columns A through C of Line 7, and enter the total on Line 8. This is the total tax due. CAUTION: LINE 8

MUST BE FILLED IN. If you do not have any rental motor vehicle or tour vehicle activity and therefore have no tax due,

enter a zero (0) on Line 8.

BTK has added $ 2,385, $ 30, and $ 65 for a total of $ 2,480 which is entered on Line 8.

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4