Form Ia 100f - Iowa Capital Gain Deduction - Esop

ADVERTISEMENT

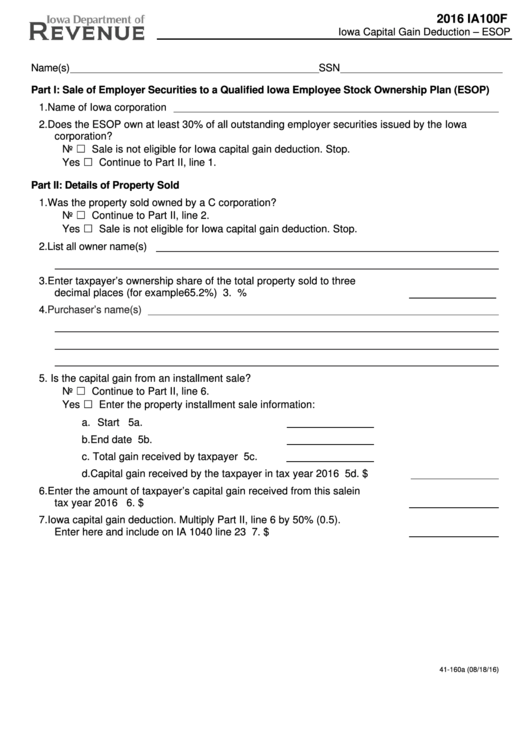

2016 IA 100F

Iowa Capital Gain Deduction – ESOP

https://tax.iowa.gov

Name(s)

SSN

Part I: Sale of Employer Securities to a Qualified Iowa Employee Stock Ownership Plan (ESOP)

1. Name of Iowa corporation

2. Does the ESOP own at least 30% of all outstanding employer securities issued by the Iowa

corporation?

No ☐ ...... Sale is not eligible for Iowa capital gain deduction. Stop.

Yes ☐ .... Continue to Part II, line 1.

Part II: Details of Property Sold

1. Was the property sold owned by a C corporation?

No ☐ ...... Continue to Part II, line 2.

Yes ☐ .... Sale is not eligible for Iowa capital gain deduction. Stop.

2. List all owner name(s)

3. Enter taxpayer’s ownership share of the total property sold to three

decimal places (for example 65.2%) ............................................................ 3.

%

4.

Purchaser’s name(s)

5. Is the capital gain from an installment sale?

No ☐ ...... Continue to Part II, line 6.

Yes ☐ .... Enter the property installment sale information:

a. Start date............................................ 5a.

b. End date ............................................. 5b.

c. Total gain received by taxpayer ......... 5c.

d. Capital gain received by the taxpayer in tax year 2016 ................ 5d. $

6. Enter the amount of taxpayer’s capital gain received from this sale in

tax year 2016 .............................................................................................. 6. $

7. Iowa capital gain deduction. Multiply Part II, line 6 by 50% (0.5).

Enter here and include on IA 1040 line 23 ................................................... 7. $

41-160a (08/18/16)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1