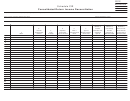

Schedule Cu - Civil Union Income Report - 2012 Page 2

ADVERTISEMENT

Column A

Column B

Column C

Your federal

Partner’s federal

“As if married”

return

return

return

23

23

Penalty on early withdrawal of savings (federal Form 1040, Line 30)

24

24

Alimony paid (federal Form 1040, Line 31a)

25

25

IRA deduction (federal Form 1040, Line 32; or 1040A, Line 17)

26

Student loan interest deduction (federal Form 1040, Line 33;

26

or 1040A, Line 18)

27

27

Tuition and fees (federal Form 1040, Line 34; or 1040A, Line 19)

28

Domestic production activities deduction

28

(federal Form 1040, Line 35)

29

Adjusted gross income

29

(federal Form 1040, Line 37; 1040A, Line 21; 1040EZ, Line 4)

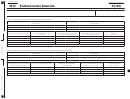

Schedule CU Instructions

General Information

What is the purpose of Schedule CU?

What if I need additional assistance?

Since same-sex civil union partners are not allowed to file “married”

If you need assistance,

returns with the Internal Revenue Service (IRS), you and your

visit our website at tax.illinois.gov,

partner must complete an “as-if-married-filing-jointly” federal return or

call our Taxpayer Assistance Division at 1 800 732-8866 or

“as-if-married-filing-separately” federal returns before completing an

217 782-3336, or

Illinois income tax return.

call our TDD (telecommunications device for the deaf) at

Schedule CU, Civil Union Income Report, allows you to report the

1 800 544-5304.

amounts from the federal returns you and your partner filed with the

Our office hours are 8 a.m. to 5 p.m. Monday through Friday.

IRS, along with the amounts from your “as-if-married” federal return.

Specific Instructions

Step 1: Provide the following information

You must use your Illinois filing status and adjusted gross

income from Column C to compute items that are phased out

Write your and your partner’s names and Social Security numbers as

as adjusted gross income increases or that are not allowed on

shown on your Form IL-1040, Individual Income Tax Return.

married filing separate returns. For example, if you elect to file

Step 2: Enter the amounts from your federal returns

separate returns, you cannot claim your federal deductions for

Column A -

Write the amounts exactly as reported on the federal

student loan interest or higher education tuition, because these

income tax return you filed with the Internal Revenue Service.

items cannot be claimed on a married filing separate return.

Column B -

If you and your partner are filing a joint Illinois

If you file a joint return, you may need to recompute these

Individual Income Tax return, write the amounts exactly as reported

deductions to reflect your joint adjusted gross income.

on the federal income tax return your partner filed with the Internal

You may need to make some adjustments that are not covered

Revenue Service.

by the federal return instructions. For example, if your employer-

Column C -

If you are filing a joint Illinois Individual Income Tax

provided health insurance covers your partner, the premiums

return, write the amounts from the “as-if-married-filing-jointly” federal

you paid for your partner’s coverage would be excluded from

return you and your partner completed for Illinois tax purposes. If you

your taxable wages shown on your W-2 form if federal law

are filing a separate Illinois Individual Income Tax return, write the

treated you as spouses, but they will be included in your

amounts from the “as-if-married-filing-separately” federal return you

taxable wages if you are in a same-sex civil union. You should

completed for Illinois tax purposes.

exclude the cost of these premiums from your taxable wages

In completing the “as-if-married” return amounts in Column C:

when completing Column C of your Schedule CU. Contact

You must follow all of the federal instructions for the filing status

your employer to determine the amounts needed to make this

you choose, and recompute items as if you had filed your federal

adjustment, and keep this information in your records.

return using the status you have elected for Illinois purposes.

Note: If excluding these premiums from your income causes

For example, if you are filing a joint return, your capital losses

you to have too much Illinois tax withheld by your employer, you

may offset your partner’s capital gains. However, if you reported

may file a new Form IL-W-4, Employee’s Illinois Withholding

the $3,000 maximum net loss deduction on your federal return,

Allowance Certificate and Instructions, with your employer

and you elect to file a separate Illinois return, you will be allowed

claiming additional allowances using Step 2, Lines 6 and 7.

only the $1,500 maximum capital loss deduction allowed for

If you have a federal net operating loss this year or a federal net

married filing separate returns on your Column C. If you and

operating loss carryback or carryover to this year and you use

your partner both reported the maximum $3,000 capital loss

that loss to offset income of your partner in Column C of your

deduction on your federal returns, you will only be allowed one

joint return, you may not carry that loss to any other year, even if

$3,000 loss deduction in Column C of your joint return or you

you file separately in that year or file a joint return with a different

will each be allowed only the $1,500 separate loss deduction in

partner.

Column C of your separate returns.

Note: This list contains examples and is not an all-inclusive list.

Page 2

IL–1040 Schedule CU (N-12/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2