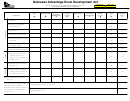

FORM

Nebraska Advantage Act Incentive Computation

312N

for use with Forms 1120N, 1120-SN, 1120NF, 1065N, 1041N, and 1040N

Page 2

Name on Return

Project Number

Tier

Date of Application Nebraska ID Number

Year End

Section 1 — Analysis of Employment

Statewide Information for Unitary Group (Report Head Count)

A

B

Calendar Quarter

1 Column A. Enter the last day of the calendar quarter prior to the application date.

Year End

___/___/___

___/___/___

1

Column B. Enter the last day of the year reported on this return . . . . . . . . . . . . . . . . . . . . . . .

2 Number of paychecks issued in this last pay period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Average annual employee compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

Project Information [Report Full-time Equivalent (FTE) Information]

4 Adjusted base-year FTEs (Schedule A, FTE column, line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Average compensation for new employees (Schedule A, line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Income tax withholding ratio for Tiers 1, 2, 3, 4, and 6 (Schedule A, line 18) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 FTE growth (Schedule A, line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

Section 2 — Analysis of Investment

8 Direct refunds for current year investment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Current year investment of qualified property (Schedule B, line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Cumulative net investment in the project (Schedule B, line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Section 3 — Establishment and Usage of Tax Credits

Investment Credit

Compensation Credit

11 a Tax credits carried forward from prior year’s filing (Form 312N, Page 2, line 21) . . 11a

b Change of tax credits from amended filing (Form 312XN, line 21) . . . . . . . . . . . . . 11b

c Adjustment for recapture or Department determination (Attach an explanation) . . 11c

d Total tax credits carried forward (add lines 11a, 11b, and 11c) . . . . . . . . . . . . . . . . 11d

12 Compensation credits used to offset income tax withholding . . . . . . . . . . . . . . . . . . 12

13 Tax credits used for sales or use tax refunds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Tax credits used for refunds of real estate taxes paid (Tiers 2LDC and 6 only) . . . . . 14

15 Remaining balance of tax credits carried forward (line 11d minus lines 12, 13, and 14)

15

16 Compensation credit earned (Schedule A, line 15). . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Investment credit earned (Schedule B, line 16) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Total available tax credits (add lines 15, 16, and 17) . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Tax credits used in current year against income tax liability (enter here and on

Form 3800N, line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Tax credits distributed to partners, shareholders, members, patrons, or

beneficiaries (Schedule II, line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21 Ending balance of tax credits to be carried forward to next year (line 18 minus

lines 19 and 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

8-703-2013 Rev. 5-2016

1

1 2

2