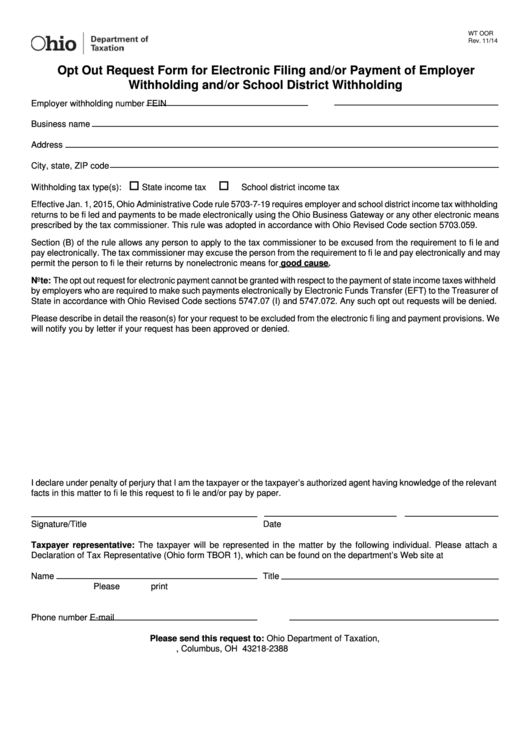

Reset Form

WT OOR

Rev. 11/14

Opt Out Request Form for Electronic Filing and/or Payment of Employer

Withholding and/or School District Withholding

Employer withholding number

FEIN

Business name

Address

City, state, ZIP code

Withholding tax type(s):

State income tax

School district income tax

Effective Jan. 1, 2015, Ohio Administrative Code rule 5703-7-19 requires employer and school district income tax withholding

returns to be fi led and payments to be made electronically using the Ohio Business Gateway or any other electronic means

prescribed by the tax commissioner. This rule was adopted in accordance with Ohio Revised Code section 5703.059.

Section (B) of the rule allows any person to apply to the tax commissioner to be excused from the requirement to fi le and

pay electronically. The tax commissioner may excuse the person from the requirement to fi le and pay electronically and may

permit the person to fi le their returns by nonelectronic means for good cause.

Note: The opt out request for electronic payment cannot be granted with respect to the payment of state income taxes withheld

by employers who are required to make such payments electronically by Electronic Funds Transfer (EFT) to the Treasurer of

State in accordance with Ohio Revised Code sections 5747.07 (I) and 5747.072. Any such opt out requests will be denied.

Please describe in detail the reason(s) for your request to be excluded from the electronic fi ling and payment provisions. We

will notify you by letter if your request has been approved or denied.

I declare under penalty of perjury that I am the taxpayer or the taxpayer’s authorized agent having knowledge of the relevant

facts in this matter to fi le this request to fi le and/or pay by paper.

Signature/Title

Date

Phone number

Taxpayer representative: The taxpayer will be represented in the matter by the following individual. Please attach a

Declaration of Tax Representative (Ohio form TBOR 1), which can be found on the department’s Web site at tax.ohio.gov.

Name

Title

Please print

Phone number

E-mail

Please send this request to: Ohio Department of Taxation,

P.O. Box 182388, Columbus, OH 43218-2388

1

1