Form Ct-638 - Start-Up Ny Tax Elimination Credit - 2014 Page 2

ADVERTISEMENT

Page 2 of 3 CT-638 (2014)

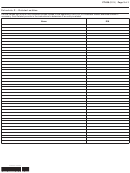

Schedule C – New York S corporation three factor formula business allocation percentage

(C corporations do not complete this schedule)

12 Three factor formula business allocation percentage

...............................................

12

%

(see instructions)

Schedule D – Tax factor

(complete Part 1 or Part 2; see instructions; New York S corporations do not

complete this schedule)

Part 1 – Corporations computing their own credit

(see instructions)

13 Enter your tax ....................................................................................................................................

13

14 All other credits applied against your tax ...........................................................................................

14

15 Tax factor ...........................................................................................................................................

15

Part 2 – Corporate partners

(see instructions)

16 Tax from your franchise tax return

............................................................................

16

(see instructions)

17 All other credits applied against your tax

..................................................................

17

(see instructions)

18 Tax factor before partnership allocation

....................................................................

18

(see instructions)

19 Your share of partnership income allocated to New York State

...............................

19

(see instructions)

20 Partners entire net income or minimum taxable income allocated to New York State ......................

20

21 Divide line 19 by line 20

.......................................................................................

21

(cannot exceed 1.0)

22 Corporate partners tax factor

................................

22

(multiply line 18 by line 21; enter here and on line 24)

Schedule E – Computation of credit

23 Allocation factor

..........................................................

23

(from line 11; corporate partners see instructions)

24 Tax factor

.........................................................................................................

24

(from line 15 or line 22)

25 Total credit

..................................................................................................

25

(multiply line 23 by line 24)

Schedule F – Computation of tax credit used, refunded, or credited as an overpayment to the next year

(New York S corporations do not complete this schedule)

26 Tax due before credits

................................................................................................ 26

(see instructions)

27 Tax credits claimed before this credit

.......................................................................

27

(see instructions)

28 Subtract line 27 from line 26 ................................................................................................................ 28

29 If line 23 equals 1.0, enter 0. If line 23 is less than 1.0, enter your fixed dollar minimum tax from

Form CT-3, line 74b, or Form CT-3-A, line 74b ................................................................................ 29

30 Credit limitation

........................................................................................

30

(subtract line 29 from line 28)

31 Credit used this year

31

...............

(enter the lesser of line 25 or line 30, here and on your franchise tax return)

32 Unused credit available as a refund or as an overpayment

.....................

32

(subtract line 31 from line 25)

33 Amount of credit to be refunded

(limited to the amount on line 32; enter here and on your franchise

.........................................................................................................................................

tax return)

33

34 Amount of credit to be applied as an overpayment to next year’s tax

(subtract line 33 from line 32;

..........................................................................................

34

enter here and on your franchise tax return)

549002140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3