01-158

(Rev.8-12/2)

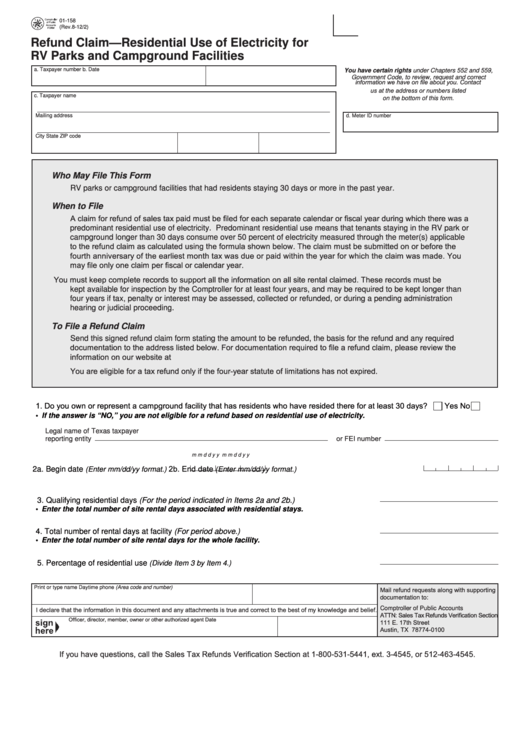

Refund Claim—Residential Use of Electricity for

RV Parks and Campground Facilities

a. Taxpayer number

b. Date

You have certain rights under Chapters 552 and 559,

Government Code, to review, request and correct

information we have on file about you. Contact

us at the address or numbers listed

c. Taxpayer name

on the bottom of this form.

Mailing address

d. Meter ID number

City

State

ZIP code

Who May File This Form

RV parks or campground facilities that had residents staying 30 days or more in the past year.

When to File

A claim for refund of sales tax paid must be filed for each separate calendar or fiscal year during which there was a

predominant residential use of electricity. Predominant residential use means that tenants staying in the RV park or

campground longer than 30 days consume over 50 percent of electricity measured through the meter(s) applicable

to the refund claim as calculated using the formula shown below. The claim must be submitted on or before the

fourth anniversary of the earliest month tax was due or paid within the year for which the claim was made. You

may file only one claim per fiscal or calendar year.

You must keep complete records to support all the information on all site rental claimed. These records must be

kept available for inspection by the Comptroller for at least four years, and may be required to be kept longer than

four years if tax, penalty or interest may be assessed, collected or refunded, or during a pending administration

hearing or judicial proceeding.

To File a Refund Claim

Send this signed refund claim form stating the amount to be refunded, the basis for the refund and any required

documentation to the address listed below. For documentation required to file a refund claim, please review the

information on our website at

You are eligible for a tax refund only if the four-year statute of limitations has not expired.

1. Do you own or represent a campground facility that has residents who have resided there for at least 30 days?

Yes

No

•

If the answer is “NO,” you are not eligible for a refund based on residential use of electricity.

Legal name of

Texas taxpayer

or FEI number

reporting entity

m

m

d

d

y

y

m

m

d

d

y

y

2b. End date

2a. Begin date

.......

......

(Enter mm/dd/yy format.)

(Enter mm/dd/yy format.)

3. Qualifying residential days (For the period indicated in Items 2a and 2b.) ............................... 3.

•

Enter the total number of site rental days associated with residential stays.

4. Total number of rental days at facility (For period above.) ........................................................ 4.

•

Enter the total number of site rental days for the whole facility.

5. Percentage of residential use

(Divide Item 3 by Item 4.)

............................................................. 5.

Print or type name

Daytime phone (Area code and number)

Mail refund requests along with supporting

documentation to:

I declare that the information in this document and any attachments is true and correct to the best of my knowledge and belief.

Comptroller of Public Accounts

ATTN: Sales Tax Refunds Verification Section

Officer, director, member, owner or other authorized agent

Date

111 E. 17th Street

Austin, TX 78774-0100

If you have questions, call the Sales Tax Refunds Verification Section at 1-800-531-5441, ext. 3-4545, or 512-463-4545.

1

1