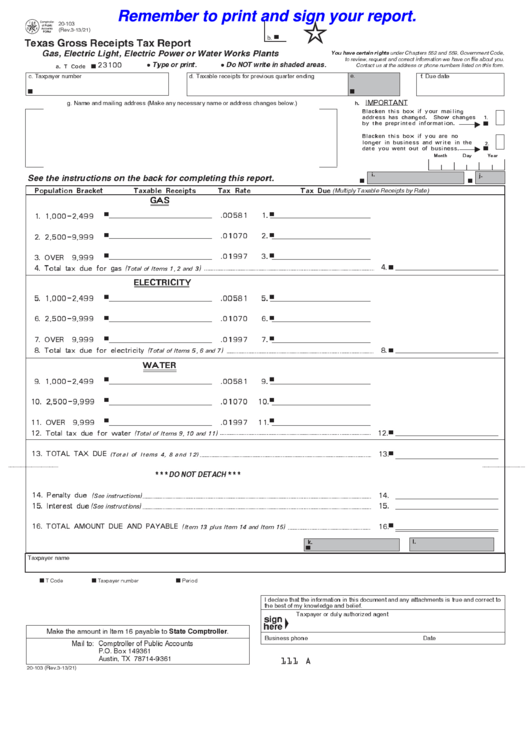

Remember to print and sign your report.

20-103

PRINT

(Rev.3-13/21)

b.

Texas Gross Receipts Tax Report

Gas, Electric Light, Electric Power or Water Works Plants

under Chapters 552 and 559, Government Code,

You have certain rights

to review, request and correct information we have on file about you.

23100

Type or print.

Do NOT write in shaded areas.

Contact us at the address or phone numbers listed on this form.

a. T Code

e.

c. Taxpayer number

d. Taxable receipts for previous quarter ending

f. Due date

IMPORTANT

g. Name and mailing address (Make any necessary name or address changes below.)

h.

Blacken this box if your mailing

address has changed. Show changes

1.

by the preprinted information.

Blacken this box if you are no

longer in business and write in the

2.

date you went out of business.

ABCBCBD

Month

Day

Year

See the instructions on the back for completing this report.

i.

j.

Population Bracket

Taxable Receipts

Tax Rate

Tax Due

GAS

(Multiply Taxable Receipts by Rate)

.00581

1.

1. 1,000-2,499

.01070

2.

2. 2,500-9,999

.01997

3.

3. OVER 9,999

4.

4. Total tax due for gas

(Total of Items 1, 2 and 3)

ELECTRICITY

5. 1,000-2,499

.00581

5.

6. 2,500-9,999

.01070

6.

7. OVER 9,999

.01997

7.

8. Total tax due for electricity

8.

(Total of Items 5, 6 and 7)

WATER

9. 1,000-2,499

.00581

9.

10. 2,500-9,999

.01070

10.

11. OVER 9,999

.01997

11.

12. Total tax due for water

12.

(Total of Items 9, 10 and 11)

13. TOTAL TAX DUE

13.

(Total of Items 4, 8 and 12)

* * * DO NOT DETACH * * *

14. Penalty due

14.

(See instructions)

15. Interest due

15.

(See instructions)

16. TOTAL AMOUNT DUE AND PAYABLE

16.

(Item 13 plus Item 14 and Item 15)

l.

k.

Taxpayer name

T Code

Taxpayer number

Period

I declare that the information in this document and any attachments is true and correct to

the best of my knowledge and belief.

Taxpayer or duly authorized agent

State Comptroller

Make the amount in Item 16 payable to

.

Business phone

Date

Mail to:

Comptroller of Public Accounts

P.O. Box 149361

Austin, TX 78714-9361

111 A

20-103 (Rev.3-13/21)

1

1 2

2