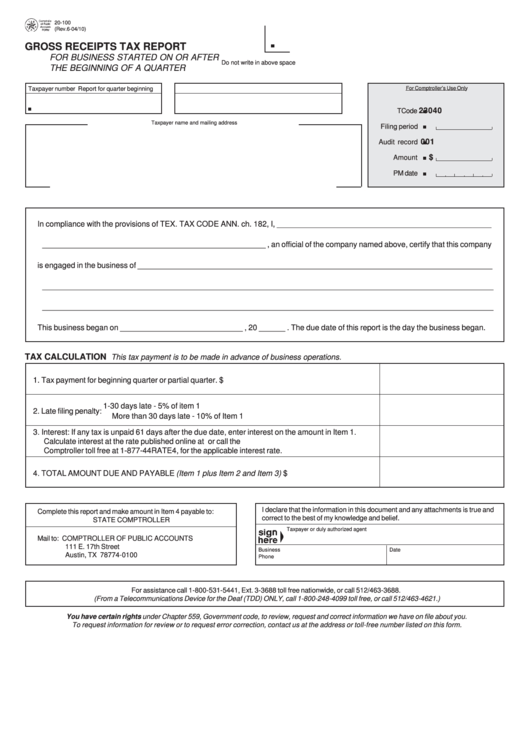

20-100

(Rev.6-04/10)

GROSS RECEIPTS TAX REPORT

FOR BUSINESS STARTED ON OR AFTER

Do not write in above space

THE BEGINNING OF A QUARTER

For Comptroller’s Use Only

Taxpayer number

Report for quarter beginning

23040

TCode

Taxpayer name and mailing address

Filing period

001

Audit record

$

Amount

PM date

In compliance with the provisions of TEX. TAX CODE ANN. ch. 182, I, _________________________________________________

___________________________________________________ , an official of the company named above, certify that this company

is engaged in the business of _________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

This business began on ____________________________ , 20 ______ . The due date of this report is the day the business began.

TAX CALCULATION

This tax payment is to be made in advance of business operations.

1. Tax payment for beginning quarter or partial quarter.

$

1-30 days late - 5% of item 1

2. Late filing penalty:

More than 30 days late - 10% of Item 1

3. Interest: If any tax is unpaid 61 days after the due date, enter interest on the amount in Item 1.

Calculate interest at the rate published online at or call the

Comptroller toll free at 1-877-44RATE4, for the applicable interest rate.

4. TOTAL AMOUNT DUE AND PAYABLE (Item 1 plus Item 2 and Item 3)

$

I declare that the information in this document and any attachments is true and

Complete this report and make amount in Item 4 payable to:

correct to the best of my knowledge and belief.

STATE COMPTROLLER

Taxpayer or duly authorized agent

Mail to: COMPTROLLER OF PUBLIC ACCOUNTS

111 E. 17th Street

Business

Date

Austin, TX 78774-0100

Phone

For assistance call 1-800-531-5441, Ext. 3-3688 toll free nationwide, or call 512/463-3688.

(From a Telecommunications Device for the Deaf (TDD) ONLY, call 1-800-248-4099 toll free, or call 512/463-4621.)

You have certain rights under Chapter 559, Government code, to review, request and correct information we have on file about you.

To request information for review or to request error correction, contact us at the address or toll-free number listed on this form.

1

1