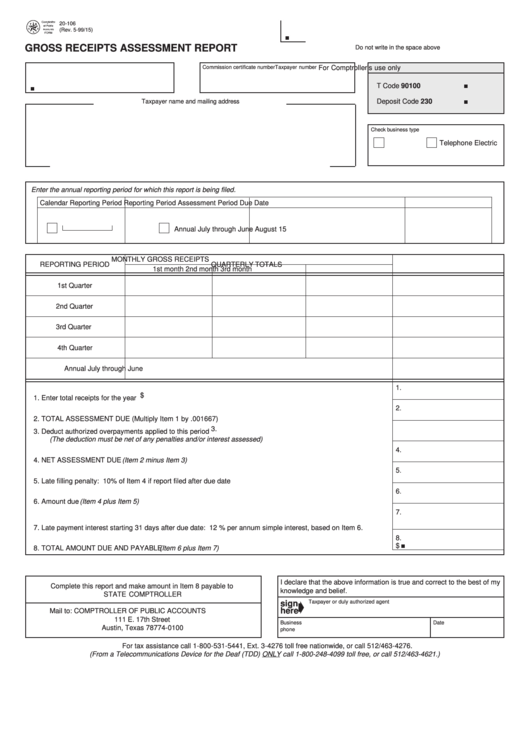

20-106

PRINT FORM

CLEAR FORM

(Rev. 5-99/15)

GROSS RECEIPTS ASSESSMENT REPORT

Do not write in the space above

For Comptroller’s use only

Taxpayer number

Commission certificate number

T Code

90100

Deposit Code

230

Taxpayer name and mailing address

Check business type

Electric

Telephone

Enter the annual reporting period for which this report is being filed.

Calendar Reporting Period

Reporting Period

Assessment Period

Due Date

Annual

July

through

June

August 15

MONTHLY GROSS RECEIPTS

REPORTING PERIOD

QUARTERLY TOTALS

1st month

2nd month

3rd month

1st Quarter

2nd Quarter

3rd Quarter

4th Quarter

Annual

July

through

June

1.

$

1. Enter total receipts for the year .................................................................................................................................

2.

2. TOTAL ASSESSMENT DUE (Multiply Item 1 by .001667) ........................................................................................

3.

3. Deduct authorized overpayments applied to this period

(The deduction must be net of any penalties and/or interest assessed) ..............................................................

4.

4. NET ASSESSMENT DUE (Item 2 minus Item 3) ......................................................................................................

5.

5. Late filling penalty: 10% of Item 4 if report filed after due date ................................................................................

6.

6. Amount due (Item 4 plus Item 5) ...............................................................................................................................

7.

7. Late payment interest starting 31 days after due date: 12 % per annum simple interest, based on Item 6. ............

8.

$

8. TOTAL AMOUNT DUE AND PAYABLE (Item 6 plus Item 7) .....................................................................................

I declare that the above information is true and correct to the best of my

Complete this report and make amount in Item 8 payable to

knowledge and belief.

STATE COMPTROLLER

Taxpayer or duly authorized agent

sign

here

Mail to: COMPTROLLER OF PUBLIC ACCOUNTS

111 E. 17th Street

Business

Date

Austin, Texas 78774-0100

phone

For tax assistance call 1-800-531-5441, Ext. 3-4276 toll free nationwide, or call 512/463-4276.

(From a Telecommunications Device for the Deaf (TDD) ONLY call 1-800-248-4099 toll free, or call 512/463-4621.)

1

1