PRINT FORM

CLEAR FORM

14-318

(Rev.6-11/2)

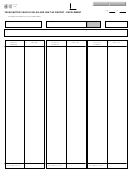

Texas Motor Vehicle Orthopedically Handicapped Exemption Certificate

Complete this certificate to claim an exemption of motor vehicle sales tax for a vehicle

that will be modified for an orthopedically handicapped person or persons.

Section 1

Purchaser: Complete this certificate and provide to selling dealer or County Tax Assessor-Collector.

Name of purchaser

Name of eligible orthopedically handicapped person

Purchaser mailing address

Purchaser phone (Area code and number)

City

State

ZIP code

Selling dealer: Retain a copy of this certificate and provide the original certificate and related required documents to the

County Tax Assessor-Collector at time of title transfer.

Name of seller

Texas dealer number

Mailing address

City

State

ZIP code

Make of vehicle

Vehicle Identification Number (VIN)

Year model

Body style

License number

I, the purchaser, claim exemption from payment of motor vehicle sales and use tax on the purchase of the vehicle

described above. The vehicle is/will be modified and will be operated primarily (80% of operating time) by or to

transport an eligible orthopedically handicapped person. I am providing

a copy of the restricted Texas Driver

License indicating required modification; or

a practitioner’s statement below.

Definitions of eligible person and vehicle modifications are on back of certificate.

Purchaser’s signature

Date

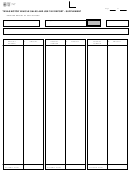

Section 2 - Practitioner of Healings Arts Statement

Name of practitioner

Professional license number

Mailing address

City

State

ZIP code

I certify that the person named in Section 1 is orthopedically handicapped, and in order to operate or be

transported in a motor vehicle in a reasonable manner, the vehicle must be modified with qualifying adaptive

devices/modifications.

Practitioner’s signature

Date

Tax Code §152.101 provides a penalty to a person who signs a false statement. An offense under this section is a felony of the third degree.

Under Ch. 559, Government Code, you are entitled to review, request and correct information we have on file about you, with limited exceptions in accordance with Ch. 552,

Government Code. To request information for review or to request error correction, contact the public information coordinator at the office where you submit this form.

1

1 2

2