Maine Minimum Tax Worksheet - 2003

ADVERTISEMENT

*0302104*

Attachment

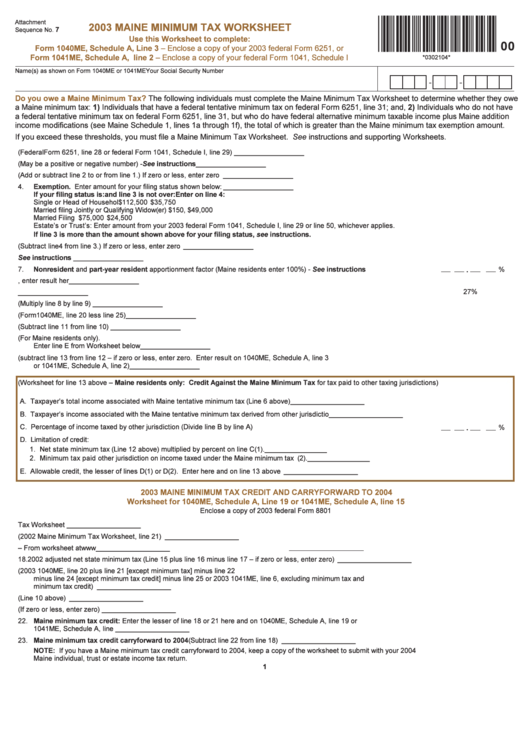

2003 MAINE MINIMUM TAX WORKSHEET

7

Sequence No.

Use this Worksheet to complete:

00

Form 1040ME, Schedule A, Line 3 – Enclose a copy of your 2003 federal Form 6251, or

Form 1041ME, Schedule A, line 2 – Enclose a copy of your federal Form 1041, Schedule I

*0302104*

Name(s) as shown on Form 1040ME or 1041ME

Your Social Security Number

-

-

Do you owe a Maine Minimum Tax?

The following individuals must complete the Maine Minimum Tax Worksheet to determine whether they owe

a Maine minimum tax: 1) Individuals that have a federal tentative minimum tax on federal Form 6251, line 31; and, 2) Individuals who do not have

a federal tentative minimum tax on federal Form 6251, line 31, but who do have federal alternative minimum taxable income plus Maine addition

income modifications (see Maine Schedule 1, lines 1a through 1f), the total of which is greater than the Maine minimum tax exemption amount.

If you exceed these thresholds, you must file a Maine Minimum Tax Worksheet. See instructions and supporting Worksheets.

1.

Federal alternative minimum taxable income (Federal Form 6251, line 28 or federal Form 1041, Schedule I, line 29) ................ 1.

__________________

2.

Modifications (May be a positive or negative number) - See instructions ..................................................................................... 2.

__________________

3.

Maine alternative minimum taxable income (Add or subtract line 2 to or from line 1.) If zero or less, enter zero .......................... 3.

__________________

4.

Exemption. Enter amount for your filing status shown below: ....................................................................................................... 4.

__________________

If your filing status is:

and line 3 is not over:

Enter on line 4:

Single or Head of Household ........................................... $112,500 ...................................................... $35,750

Married filing Jointly or Qualifying Widow(er) ................. $150,000 ...................................................... $49,000

Married Filing Separately .................................................. $75,000 ...................................................... $24,500

Estate’s or Trust’s: Enter amount from your 2003 federal Form 1041, Schedule I, line 29 or line 50, whichever applies.

If line 3 is more than the amount shown above for your filing status, see instructions.

5.

Maine minimum tax taxable income (Subtract line 4 from line 3.) If zero or less, enter zero .......................................................... 5.

__________________

6.

Tentative minimum tax for Maine purposes. See instructions ........................................................................................................ 6.

__________________

7.

Nonresident and part-year resident apportionment factor (Maine residents enter 100%) - See instructions ............................ 7.

.

%

8.

Multiply line 6 by line 7, enter result here ......................................................................................................................................... 8.

__________________

27%

9.

Rate ................................................................................................................................................................................................... 9.

__________________

10. State minimum tax (Multiply line 8 by line 9) .................................................................................................................................... 10. __________________

11. Maine income tax (Form 1040ME, line 20 less line 25) ................................................................................................................... 11. __________________

12. Net state minimum tax (Subtract line 11 from line 10) ..................................................................................................................... 12. __________________

13. Credit against the Maine minimum tax for minimum tax paid to other jurisdictions (For Maine residents only).

Enter line E from Worksheet below. ................................................................................................................................................. 13. __________________

14. Maine Minimum Tax (subtract line 13 from line 12 – if zero or less, enter zero. Enter result on 1040ME, Schedule A, line 3

or 1041ME, Schedule A, line 2) ........................................................................................................................................................ 14. __________________

(Worksheet for line 13 above – Maine residents only: Credit Against the Maine Minimum Tax for tax paid to other taxing jurisdictions)

A. Taxpayer’s total income associated with Maine tentative minimum tax (Line 6 above) .................................................................... A. ___________________

B. Taxpayer’s income associated with the Maine tentative minimum tax derived from other jurisdiction ............................................. B. ___________________

C. Percentage of income taxed by other jurisdiction (Divide line B by line A) ....................................................................................... C.

%

.

D. Limitation of credit:

1. Net state minimum tax (Line 12 above) multiplied by percent on line C .......................................... D(1). ________________

2. Minimum tax paid other jurisdiction on income taxed under the Maine minimum tax ..................... D(2). ________________

E. Allowable credit, the lesser of lines D(1) or D(2). Enter here and on line 13 above ......................................................................... E. ___________________

2003 MAINE MINIMUM TAX CREDIT AND CARRYFORWARD TO 2004

Worksheet for 1040ME, Schedule A, Line 19 or 1041ME, Schedule A, line 15

Enclose a copy of 2003 federal Form 8801

15. Enter the amount from line 12 of the 2002 Maine Minimum Tax Worksheet ................................................................................... 15. ___________________

16. Minimum tax credit carryforward from 2002 (2002 Maine Minimum Tax Worksheet, line 21) ......................................................... 16. ___________________

17. Enter 2002 net state minimum tax on federal exclusion items – From worksheet at ............................. 17. ___________________

18. 2002 adjusted net state minimum tax (Line 15 plus line 16 minus line 17 – if zero or less, enter zero) ......................................... 18. ___________________

19. Enter 2003 Maine income tax liability (2003 1040ME, line 20 plus line 21 [except minimum tax] minus line 22

minus line 24 [except minimum tax credit] minus line 25 or 2003 1041ME, line 6, excluding minimum tax and

minimum tax credit) ........................................................................................................................................................................... 19. ___________________

20. Enter 2003 Maine minimum tax (Line 10 above) .............................................................................................................................. 20. ___________________

21. Subtract line 20 from line 19 (If zero or less, enter zero) ................................................................................................................. 21. ___________________

22. Maine minimum tax credit: Enter the lesser of line 18 or 21 here and on 1040ME, Schedule A, line 19 or

1041ME, Schedule A, line 15 ............................................................................................................................................................ 22. ___________________

23. Maine minimum tax credit carryforward to 2004 (Subtract line 22 from line 18) ........................................................................ 23. ___________________

NOTE: If you have a Maine minimum tax credit carryforward to 2004, keep a copy of the worksheet to submit with your 2004

Maine individual, trust or estate income tax return.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3