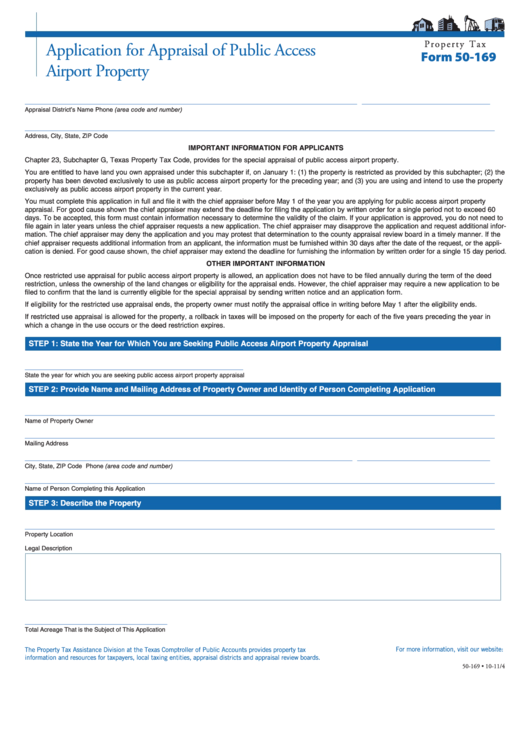

P r o p e r t y T a x

Application for Appraisal of Public Access

Form 50-169

Airport Property

______________________________________________________________________

___________________________

Appraisal District’s Name

Phone (area code and number)

___________________________________________________________________________________________________

Address, City, State, ZIP Code

IMPORTANT INFORMATION FOR APPLICANTS

Chapter 23, Subchapter G, Texas Property Tax Code, provides for the special appraisal of public access airport property.

You are entitled to have land you own appraised under this subchapter if, on January 1: (1) the property is restricted as provided by this subchapter; (2) the

property has been devoted exclusively to use as public access airport property for the preceding year; and (3) you are using and intend to use the property

exclusively as public access airport property in the current year.

You must complete this application in full and file it with the chief appraiser before May 1 of the year you are applying for public access airport property

appraisal. For good cause shown the chief appraiser may extend the deadline for filing the application by written order for a single period not to exceed 60

days. To be accepted, this form must contain information necessary to determine the validity of the claim. If your application is approved, you do not need to

file again in later years unless the chief appraiser requests a new application. The chief appraiser may disapprove the application and request additional infor-

mation. The chief appraiser may deny the application and you may protest that determination to the county appraisal review board in a timely manner. If the

chief appraiser requests additional information from an applicant, the information must be furnished within 30 days after the date of the request, or the appli-

cation is denied. For good cause shown, the chief appraiser may extend the deadline for furnishing the information by written order for a single 15 day period.

OTHER IMPORTANT INFORMATION

Once restricted use appraisal for public access airport property is allowed, an application does not have to be filed annually during the term of the deed

restriction, unless the ownership of the land changes or eligibility for the appraisal ends. However, the chief appraiser may require a new application to be

filed to confirm that the land is currently eligible for the special appraisal by sending written notice and an application form.

If eligibility for the restricted use appraisal ends, the property owner must notify the appraisal office in writing before May 1 after the eligibility ends.

If restricted use appraisal is allowed for the property, a rollback in taxes will be imposed on the property for each of the five years preceding the year in

which a change in the use occurs or the deed restriction expires.

STEP 1: State the Year for Which You are Seeking Public Access Airport Property Appraisal

______________________________________________

State the year for which you are seeking public access airport property appraisal

STEP 2: Provide Name and Mailing Address of Property Owner and Identity of Person Completing Application

___________________________________________________________________________________________________

Name of Property Owner

___________________________________________________________________________________________________

Mailing Address

_____________________________________________________________________

____________________________

City, State, ZIP Code

Phone (area code and number)

___________________________________________________________________________________________________

Name of Person Completing this Application

STEP 3: Describe the Property

___________________________________________________________________________________________________

Property Location

Legal Description

______________________________

Total Acreage That is the Subject of This Application

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-169 • 10-11/4

1

1 2

2 3

3