Form 50-182 - Tax Certificate

Download a blank fillable Form 50-182 - Tax Certificate in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 50-182 - Tax Certificate with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

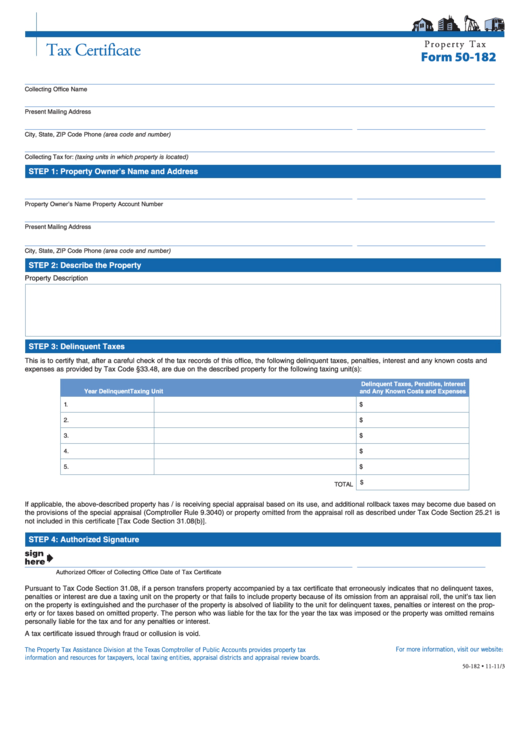

P r o p e r t y T a x

Tax Certificate

Form 50-182

___________________________________________________________________________________________________

Collecting Office Name

___________________________________________________________________________________________________

Present Mailing Address

_____________________________________________________________________

___________________________

City, State, ZIP Code

Phone (area code and number)

___________________________________________________________________________________________________

Collecting Tax for: (taxing units in which property is located)

STEP 1: Property Owner’s Name and Address

_____________________________________________________________________

___________________________

Property Owner’s Name

Property Account Number

___________________________________________________________________________________________________

Present Mailing Address

_____________________________________________________________________

___________________________

City, State, ZIP Code

Phone (area code and number)

STEP 2: Describe the Property

Property Description

STEP 3: Delinquent Taxes

This is to certify that, after a careful check of the tax records of this office, the following delinquent taxes, penalties, interest and any known costs and

expenses as provided by Tax Code §33.48, are due on the described property for the following taxing unit(s):

Delinquent Taxes, Penalties, Interest

Year Delinquent

Taxing Unit

and Any Known Costs and Expenses

1.

$

2.

$

3.

$

4.

$

5.

$

$

TOTAL

If applicable, the above-described property has / is receiving special appraisal based on its use, and additional rollback taxes may become due based on

the provisions of the special appraisal (Comptroller Rule 9.3040) or property omitted from the appraisal roll as described under Tax Code Section 25.21 is

not included in this certificate [Tax Code Section 31.08(b)].

STEP 4: Authorized Signature

_____________________________________________________________________

___________________________

Authorized Officer of Collecting Office

Date of Tax Certificate

Pursuant to Tax Code Section 31.08, if a person transfers property accompanied by a tax certificate that erroneously indicates that no delinquent taxes,

penalties or interest are due a taxing unit on the property or that fails to include property because of its omission from an appraisal roll, the unit’s tax lien

on the property is extinguished and the purchaser of the property is absolved of liability to the unit for delinquent taxes, penalties or interest on the prop-

erty or for taxes based on omitted property. The person who was liable for the tax for the year the tax was imposed or the property was omitted remains

personally liable for the tax and for any penalties or interest.

A tax certificate issued through fraud or collusion is void.

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-182 • 11-11/3

true

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1