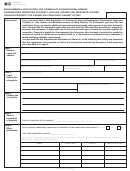

P r o p e r t y T a x

Application for Charitable Organizations Improving Property for Low-Income Housing Property Tax Exemption

Form 50-263

STEP 3: Answer the Following Questions About the Applicant Organization

1. Is the organization organized as a community housing development organization (42 U.S.C. Section 12704)? . . . . . . . . . . . . . . .

Yes

No

2. Is the organization engaged primarily in public charitable functions? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If yes, using an attachment, describe the organization’s activities in a narrative. The narrative description of activities should be

thorough, accurate and include date-specific references to the tax year for which the exemption is sought. You may also attach

representative copies of newsletters, brochures or similar documents for supporting details to this narrative.

3. Is the organization organized exclusively to perform religious, charitable, scientific, literary or educational purposes? . . . . . . . . . .

Yes

No

If yes, attach copies of organizational documents supporting your answer.

4. Does the organization own the property for the purpose of building or repairing housing on it to sell or rent without profit to an

individual or family satisfying the organization’s low-income or moderate-income eligibility requirements? . . . . . . . . . . . . . . . . . . .

Yes

No

5. Does the organization engage exclusively in the building, repair and sale or rental of housing as described above, and related

activities? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

6. Does the organization perform, or does its charter permit it to perform, any functions other than those checked in question 3? . . . .

Yes

No

If “YES,” attach a statement describing the other functions in detail.

7. In the past year has the organization loaned funds to, borrowed funds from, sold property to or bought property from a shareholder,

director or member of the organization, or has a shareholder or member sold his interest in the organization for a profit?. . . . . . .

Yes

No

If “YES,” attach a description of each transaction. For sales, give buyer, seller, price paid, value of the property sold and date

of sale. For loans, give lender, borrower, amount borrowed, interest rate and term of loan. Attach a copy of note, if any.

8. Does the organization operate in such a manner that does not result in the accrual of distributable profits, the distribution of

profits or the realization of any other form of private gain? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

9. Does the organization operate, or its charter permit to operate, in a manner which permits the accural of profits or distribution

of any form of private gain? If yes, please explain on a separate attached page. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

10. Does the organization have an annual audit, including a detailed report on the organization’s sources and uses of funds,

prepared by an independent auditor? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Please deliver a copy of the annual audit to the chief appraiser of this appraisal district and to the Texas Department of Housing and Community Affairs, as

required by Tax Code Section 11.182(g).

STEP 4: Answer these Questions About the Applicant Organization Bylaws or Charter

Attach a copy of the charter, bylaws or other documents adopted by the organization which govern its affairs, and answer the following questions.

1. Do these documents pledge the organization’s assets for use in performing the organization’s charitable functions?. . . . . . . . . . .

Yes

No

_________

_________

If “YES,” give the page and paragraph numbers.

Page

Paragraph

2. Do these documents direct that on the discontinuance of the organization, the organization’s assets are to be transferred to the

State of Texas or to an educational, religious, charitable or other similar organization that is qualified for exemption under

Section 501(c)(3), Internal Revenue Code, as amended? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

_________

_________

If “YES,” give the page and paragraph numbers.

Page

Paragraph

If “NO,” do these documents direct that on discontinuance of the organization, the organization’s assets are to be transferred to

its members who have promised in their membership application to immediately transfer them to the State of Texas or to an

educational, religious, charitable or other similar organization that is qualified for exemption under Section 501(c)(3), Internal

Revenue Code, as amended? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

_________

_________

If “YES,” give the page and paragraph numbers.

Page

Paragraph

If “YES,” was this two-step transfer required for the organization to qualify for exemption under Sec. 501(c)(12), Internal Revenue

Code, as amended? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

STEP 5: Describe the Property for Which Exemption is Sought

PROPERTY TO BE EXEMPT:

• Attach one Schedule A (REAL PROPERTY) form for EACH parcel of real improved and unimproved property to be exempt.

• Attach one Schedule B (BUILDINGS) form for EACH building to be exempt.

• Attach one Schedule C (PERSONAL PROPERTY) form listing ALL personal property to be exempt.

For more information, visit our website:

Page 2 • 50-263 • 11-11/6

1

1 2

2 3

3 4

4 5

5 6

6 7

7