P r o p e r t y T a x

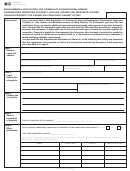

Application for Charitable Organizations Improving Property for Low-Income Housing Property Tax Exemption

Form 50-263

Schedule A: Description of Real Property

• Complete one Schedule A form for EACH parcel of improved and unimproved real property qualified for exemption.

• Attach all completed schedules to your application for exemption.

___________________________________________________________________________________________________

Name of Property Owner

_____________________________________________________________

__________________________________

Legal Description of Property (if known)

Appraisal District Account Number (if known)

___________________________________________________________________________________________________

Describe the Primary Use of This Property

____________________

Date of Acquisition of the Property

Is this property reasonably necessary for operation of the association/organization?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Answer the following questions if this real property is a multifamily rental property consisting of 36 or more dwelling units owned

by the organization.

1. Was this property acquired by the organization using tax-exempt bond financing after January 1, 1997, and before

December 31, 2001? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

2. Does the entity that provides the financing for acquiring or constructing the property require the organization to make payment

in lieu of taxes to the school district in which the property is located? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

3. Does the entity that provides the financing for acquiring or constructing the property restrict the amount of rent the organization

may charge for the dwelling units?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

4. Has the organization entered into an agreement with each taxing unit for which the property receives exemption to spend in each

tax year an amount equal to the total amount of taxes imposed on the property in the tax year preceding the year in which the

organization acquired the property for the purposes of social, educational, or economic development services, capital

improvement projects, or rent reduction for eligible persons in the county? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If the answers to all four questions above is “No,” answer the following question(s).

5. In the preceding tax year, what is the amount of total taxes that would have been imposed on the property without

______________

the exemption? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

6. In the preceding tax year, how much did the organization spend, for eligible persons in the county, on the following areas:

____________________

Social, educational, or economic development services

$

____________________

Capital improvement projects

$

____________________

Rent reduction

$

____________________

Total spent in preceding year

$

Answer the following questions if this real property is a housing project constructed after December 31, 2001, and financed with qualified 501(c)(3) bonds

issued under Section 145 of the Internal Revenue Code of 1986, tax-exempt private activity bonds subject to volume cap, or low-income housing tax credits.

1. Is the project owned by a limited partnership?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

2. If yes, does the organization control l00 percent of the interest in the general partner? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

3. Does the organization comply with all rules of and laws administered by the Texas Department of Housing and Community

Affairs for community housing development organization? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

4. Did the organization submit annually to the Texas Department of Housing and Community Affairs evidence demonstrating that the

organization spent an amount equal to at least 90 percent of the project’s cash flow in the preceding fiscal year (as determined by

the annual audit) for the purposes of social, educational, or economic development services, capital improvement projects, or rent

reduction for eligible persons in the county? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

5. Did the organization submit annually to the governing body of each taxing unit exempting the project evidence demonstrating that

the organization spent an amount equal to at least 90 percent of the project’s cash flow in the preceding fiscal year (as determined

by the annual audit) for the purposes of social, educational, or economic development services, capital improvement projects, or

rent reduction for eligible persons in the county?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

For more information, visit our website:

Page 4 • 50-263 • 11-11/6

1

1 2

2 3

3 4

4 5

5 6

6 7

7