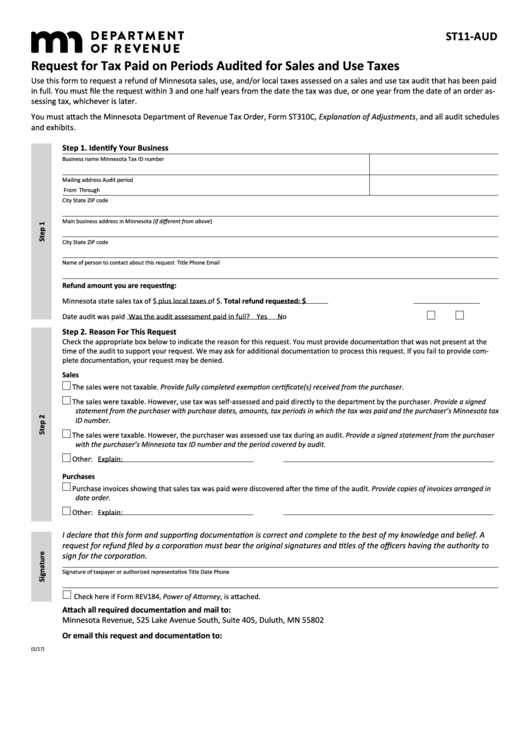

ST11-AUD

Request for Tax Paid on Periods Audited for Sales and Use Taxes

Use this form to request a refund of Minnesota sales, use, and/or local taxes assessed on a sales and use tax audit that has been paid

in full. You must file the request within 3 and one half years from the date the tax was due, or one year from the date of an order as-

sessing tax, whichever is later.

You must attach the Minnesota Department of Revenue Tax Order, Form ST310C, Explanation of Adjustments, and all audit schedules

and exhibits.

Step 1. Identify Your Business

Business name

Minnesota Tax ID number

Mailing address

Audit period

From

Through

City

State

ZIP code

Main business address in Minnesota (if different from above)

City

State

ZIP code

Name of person to contact about this request

Title

Phone

Email

Refund amount you are requesting:

Minnesota state sales tax of $

plus local taxes of $

. Total refund requested: $

Date audit was paid

Was the audit assessment paid in full?

Yes

No

Step 2. Reason For This Request

Check the appropriate box below to indicate the reason for this request. You must provide documentation that was not present at the

time of the audit to support your request. We may ask for additional documentation to process this request. If you fail to provide com-

plete documentation, your request may be denied.

Sales

The sales were not taxable. Provide fully completed exemption certificate(s) received from the purchaser.

The sales were taxable. However, use tax was self-assessed and paid directly to the department by the purchaser. Provide a signed

statement from the purchaser with purchase dates, amounts, tax periods in which the tax was paid and the purchaser’s Minnesota tax

ID number.

The sales were taxable. However, the purchaser was assessed use tax during an audit. Provide a signed statement from the purchaser

with the purchaser’s Minnesota tax ID number and the period covered by audit.

Other:

Explain:

Purchases

Purchase invoices showing that sales tax was paid were discovered after the time of the audit. Provide copies of invoices arranged in

date order.

Other:

Explain:

I declare that this form and supporting documentation is correct and complete to the best of my knowledge and belief. A

request for refund filed by a corporation must bear the original signatures and titles of the officers having the authority to

sign for the corporation.

Signature of taxpayer or authorized representative

Title

Date

Phone

Check here if Form REV184, Power of Attorney, is attached.

Attach all required documentation and mail to:

Minnesota Revenue, 525 Lake Avenue South, Suite 405, Duluth, MN 55802

Or email this request and documentation to: salesuse.claim@state.mn.us

(5/17)

1

1