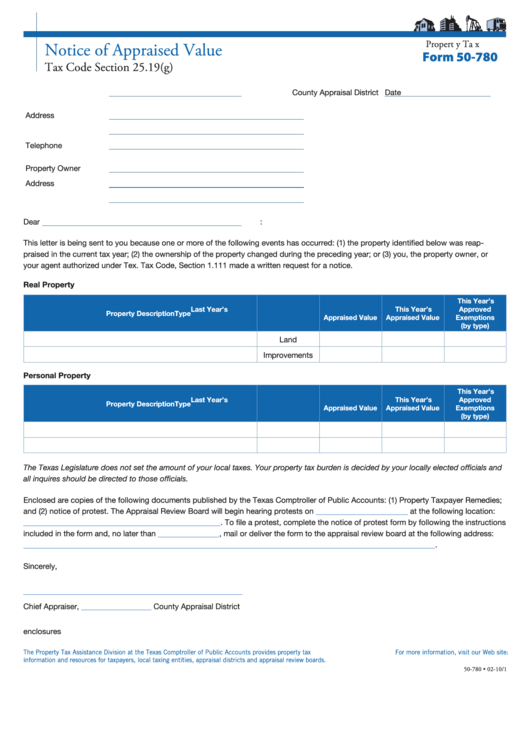

P r o p e r t y T a x

Notice of Appraised Value

Form 50-780

Tax Code Section 25.19(g)

County Appraisal District

Date

Address

Telephone

Property Owner

Address

Dear

:

This letter is being sent to you because one or more of the following events has occurred: (1) the property identified below was reap-

praised in the current tax year; (2) the ownership of the property changed during the preceding year; or (3) you, the property owner, or

your agent authorized under Tex. Tax Code, Section 1.111 made a written request for a notice.

Real Property

This Year’s

Last Year’s

This Year’s

Approved

Property Description

Type

Appraised Value

Appraised Value

Exemptions

(by type)

Land

Improvements

Personal Property

This Year’s

Last Year’s

This Year’s

Approved

Property Description

Type

Appraised Value

Appraised Value

Exemptions

(by type)

The Texas Legislature does not set the amount of your local taxes. Your property tax burden is decided by your locally elected officials and

all inquires should be directed to those officials.

Enclosed are copies of the following documents published by the Texas Comptroller of Public Accounts: (1) Property Taxpayer Remedies;

_____________________

and (2) notice of protest. The Appraisal Review Board will begin hearing protests on

at the following location:

_____________________________________________

. To file a protest, complete the notice of protest form by following the instructions

______________

included in the form and, no later than

, mail or deliver the form to the appraisal review board at the following address:

______________________________________________________________________________________________

.

Sincerely,

__________________________________________________

________________

Chief Appraiser,

County Appraisal District

enclosures

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our Web site:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-780 • 02-10/1

1

1