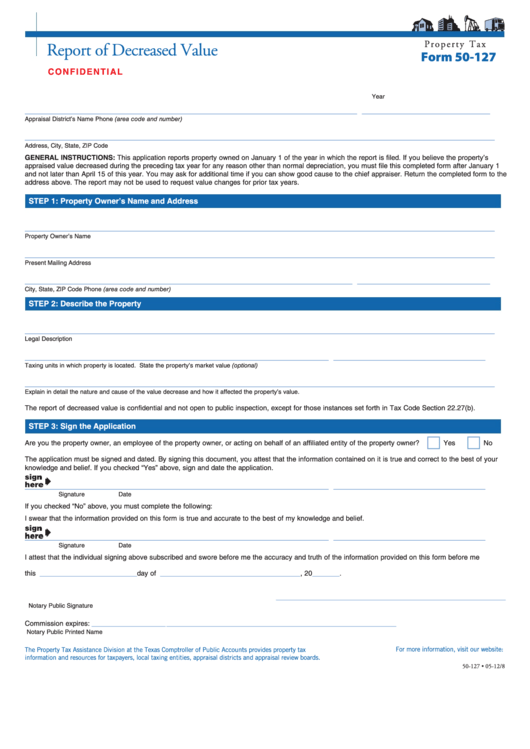

P r o p e r t y T a x

Report of Decreased Value

Form 50-127

C O N F I D E N T I A L

___________________________

Year

______________________________________________________________________

___________________________

Appraisal District’s Name

Phone (area code and number)

___________________________________________________________________________________________________

Address, City, State, ZIP Code

GENERAL INSTRUCTIONS: This application reports property owned on January 1 of the year in which the report is filed. If you believe the property’s

appraised value decreased during the preceding tax year for any reason other than normal depreciation, you must file this completed form after January 1

and not later than April 15 of this year. You may ask for additional time if you can show good cause to the chief appraiser. Return the completed form to the

address above. The report may not be used to request value changes for prior tax years.

STEP 1: Property Owner’s Name and Address

___________________________________________________________________________________________________

Property Owner’s Name

___________________________________________________________________________________________________

Present Mailing Address

_____________________________________________________________________

____________________________

City, State, ZIP Code

Phone (area code and number)

STEP 2: Describe the Property

___________________________________________________________________________________________________

Legal Description

________________________________________________________________

________________________________

Taxing units in which property is located.

State the property’s market value (optional)

___________________________________________________________________________________________________

Explain in detail the nature and cause of the value decrease and how it affected the property’s value.

The report of decreased value is confidential and not open to public inspection, except for those instances set forth in Tax Code Section 22.27(b).

STEP 3: Sign the Application

Are you the property owner, an employee of the property owner, or acting on behalf of an affiliated entity of the property owner?

Yes

No

The application must be signed and dated. By signing this document, you attest that the information contained on it is true and correct to the best of your

knowledge and belief. If you checked “Yes” above, sign and date the application.

________________________________________________________________

________________________________

Signature

Date

If you checked “No” above, you must complete the following:

I swear that the information provided on this form is true and accurate to the best of my knowledge and belief.

________________________________________________________________

________________________________

Signature

Date

I attest that the individual signing above subscribed and swore before me the accuracy and truth of the information provided on this form before me

this

_________________________

day of

____________________________________

, 20

_______

.

___________________________________________________________

Notary Public Signature

Commission expires:

___________________

___________________________________________________________

Notary Public Printed Name

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-127 • 05-12/8

1

1 2

2