Form 69-100 (Back) (Rev.9-13/11)

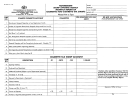

Instructions for Completing the Texas Distributor

Monthly Report of Cigarettes and Stamps

General Information

Who Must File:

Chapter 154 of the Tax Code provides that each distributor must submit to the Comptroller of Public Accounts, on or before the

last day of each month, a report which records purchases, cigarette and stamp activity for the preceding month.

Chapter 161 of the Health and Safety Code, Subchapter V, imposes reporting items in addition to those required by Chapter 154

of the Tax Code.

Each distributor must obtain a sufficient number of stamps from the Comptroller of Public Accounts to affix to cigarette

packages prior to receipt or acceptance of the cigarettes. The distributor must affix stamps within 96 hours of receipt of the

cigarettes. A distributor who possesses unstamped cigarette packages for interstate sale must possess a sufficient number of

unused stamps from the appropriate destination state to stamp the distributor's inventory of unstamped interstate cigarettes,

except for cigarette packages for which no tax is due under federal law.

For Assistance:

Call 1-800-862-2260 or 512-463-3731. Details are also available online at

Specific Instructions

If you are located in Texas, complete Items 1-11 and 13-28.

If you are located outside Texas, complete Items 12-28.

All Texas Distributor Monthly Reports of Cigarettes and Stamps must include both the Texas Distributor Receiving Record

of Cigarettes (Form 69-108) and the Texas Distributor Receiving Record of Cigarette Tax Stamps (Form 69-109).

Item l -

Permitted location - A change to the permitted location address will require you to complete and submit Form 69-121, Business

Location Supplement for Cigarette and Tobacco Products. Operating without a valid permit is subject to a penalty of not more than

$2,000 for each violation. A separate offense is committed each day on which a violation occurs.

Item 4 -

Sales to Native American Reservations - must be accompanied by completed Texas Certificates of Tax Exempt Sale (Form 69-302).

Item 5 -

Sales to Federal Organizations - must be accompanied by completed Texas Certificates of Tax Exempt Sale (Form 69-302).

Item 6 -

Cigarettes Stamped for Interstate Sales - must be accompanied by Texas Distributor Interstate Sales Report (Form 69-110).

Item 12 -

Total cigarettes sent to Texas - should be completed ONLY by out of state distributors that are shipping "stamped for Texas"

cigarettes into Texas.

Item 13 -

Non-Settling Manufacturer (NSM) or Subsequent Participating Manufacturers (SPM) cigarettes sold in Texas to Native American

Reservations, Federal Organizations or Cigarettes Stamped for Interstate Sales from Texas. Also includes NSM/SPM cigarette

returns to the manufacturer.

Item 14 -

Multiply Item 11 or Item 12 by the applicable tax rate:

If the filing period ending is prior to Jan. 1, 2007, multiply Item 11 or 12 by .0205; tax rate = $20.50 per thousand;

If the filing period ending is after Dec. 31, 2006, multiply Item 11 or 12 by .0705; tax rate = $70.50 per thousand.

Item 18 -

Stamps lost, stolen, mutilated, sold or transferred - must be accompanied by a police report, Authorization for Sale or Transfer

Cigarette Tax Stamps (Form 69-223), and/or any other documentation acceptable to the Comptroller.

Item 24 -

Value of stamps affixed - should be equal to or comparable (considering monthly close out dates) to Item 14.

Item 25 -

A distributor is entitled to an additional cigarette stamping allowance of 0.5 percent for (1) affixing cigarette stamps; (2) remitting

a fee imposed by Chapter 161 of the Health and Safety Code, Subchapter V; and (3) submitting all properly completed

distributor reports as required.

Item 26 -

Enter Non-Settling Manufacturer/Subsequent

Participating Manufacturer cigarette fee. Sum of the NSM

total cigarettes and SPM total cigarettes multiplied by the

applicable cigarette fee rates. See the Cigarette/RYO Fee

webpage for definitions and applicable fee rates.

Item 27 -

A minimum penalty of $50 is due for failure to pay the fee

on or before the due date. If the NSM/SPM fee is paid

after the due date, enter penalty. If 1-30 days late, enter

5% of Item 26; if more than 30 days late, enter 10% of

Item 26. If any fee is unpaid 61 days after the due date,

Cigarette Distributor Supporting Documentation

enter penalty and interest on the amount in Item 26.

Calculate interest at the rate published online at

Form 69-108 -

Texas Distributor Receiving Record of Cigarettes

or call

Form 69-109 -

Texas Distributor Receiving Record of Cigarette Tax Stamps

1-877-447-2836 for the applicable interest rate.

Form 69-110 -

Texas Distributor Interstate Sales Report

Form 69-302 -

Texas Certificate of Tax Exempt Sale

Electronic -

Texas Detail Supplemental Report of NSM/SPM Cigarettes

1

1 2

2