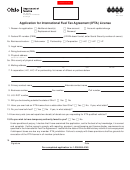

Form 56-100 (Back)(Rev.1-13/2)

Instructions for Completing Texas Continuous Bond

for International Fuel Tax Agreement License

Specific Instructions —

Who May Complete This Form —

Any International Fuel Tax Agreement license holder

who is required to post a bond to guarantee the pay-

Item 7 - If the surety company has both a Texas

taxpayer number and a Texas vendor identification

ment of fuel taxes may complete and submit this bond.

number, enter only the vendor identification number.

Use only the first eleven digits of the number.

Bonding Requirements —

bonds are not generally required of first-time appli-

cants. A bond may be required, however, if an IFTA

Item 10 - The bond form must be dated and signed by

licensee has a history of not filing tax returns on time,

an authorized agent of the surety company.

not remitting tax due or other problems to indicate that

a bond is required to protect the interests of all member

Item 11 - This bond form must be signed by the princi-

jurisdictions and the state of Texas. The Texas State

pal or authorized agent to be effective. The authorized

Comptroller will determine the required bond amount.

agent must also attach a power of attorney.

Who to Contact for Assistance —

For assistance with any Fuels Tax question, please

contact the Texas state comptroller’s office at

Mail the completed bond to:

1-800-252-1383 or 512-463-4600.

Comptroller of Public Accounts

111 E. 17th St.

General Instructions —

austin, Tx 78774-0100

•

Please write only in white areas.

•

Complete each item carefully.

when entering a federal employer identification

•

number or Social Security number, do not

enter dashes.

1

1 2

2