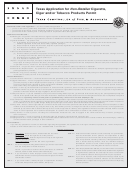

69-119 (Back)

INSTRUCTIONS FOR VENDING MACHINE INVENTORY SUPPLEMENT FOR

(Rev.7-09/4)

CIGARETTE AND/OR TOBACCO PRODUCTS PERMIT (DECAL)

WHO MUST SUBMIT THIS SUPPLEMENT – You must submit this supplement if:

·

you currently have an active retailer cigarette, cigar and/or tobacco products permit and

·

you have acquired a new vending machine or are replacing an old vending machine from which cigarettes and/or tobacco product

sales will take place.

DEFINITIONS:

In-Service Date – the date that the vending machine is displayed for retail sales of cigarettes, cigars and/or tobacco products.

Retailer – means a person who engages in the practice of selling cigarettes and/or tobacco products to consumers and includes the owner

of a coin operated cigarette and/or tobacco products vending machine.

Storage – means the business location where cigarettes, cigars and/or tobacco products are stored or kept. You must store business

records at your designated permitted place of business. A residence or a unit in a public storage facility CANNOT be used for such storage.

(Except for cigars and tobacco products Manufacturer’s Representatives.)

Commercial Location – means the entire office, plant or area of the business in any one location owned or leased by the same proprietor

where the Lessor allows the space to be used for business purposes. The location must have regular, posted business hours and cannot

be a residence, a postal box of any type or a unit in a public storage facility.

Late Fee – If you have been selling without a permit, a $50 late fee will be assessed on each vending machine that is not in compliance

with permit requirements. OPERATING WITHOUT A VALID PERMIT IS PUNISHABLE BY A FINE OF NOT MORE THAN $2000 PER DAY.

SPECIAL INSTRUCTIONS:

·

According to Texas Tax Code, Sections 154.117(c) and 155.053 (c), each retailer who operates a cigarette vending machine or a

vending machine that includes tobacco products shall place a retailer’s permit (decal) on the machine.

·

Each vending machine is assigned a unique permit (decal). Carefully affix the assigned permit (decal) to the appropriate vending

machine.

·

You must submit this supplement for an additional/new vending machine permit/decal at least 20 days prior to the date you wish to

start selling products from the vending machine.

·

A retailer or other person may not install or maintain a vending machine containing cigarettes or tobacco products in a manner that

permits a customer younger than 18 years of age direct access to the cigarettes or tobacco products.

·

You must store business records at a permitted place of business.

·

Provide the business name and address where the cigarettes and/or tobacco products vending machine will be located. (Use street

address and number or directions, city, state and ZIP Code – NOT P.O. Box or rural route and box number.)

PERMIT AND FEE INFORMATION:

Cigarettes, cigars and/or tobacco products may NOT be sold until you have received the appropriate permit. A permit will NOT be issued

until payment is received by the Comptroller. If you sell cigarette, cigar and/or tobacco products without a permit, you may forfeit a penalty

of up to $2000 and could possibly have criminal charges filed against you. Each day of operating without a permit is a separate violation.

(Sections 154.501 and 155.201).

*During the last three months of the permit period, the Comptroller may collect the prorated permit fee for the current period

AND fee for the next permit period.

RETAILER PERMIT FEE SCHEDULE:

The permit period for a Cigarette, Cigar and/or Tobacco Products RETAILER begins June 1 and expires on May 31 of each even-numbered

year. It is renewed every two years. The permit fee is $180 per biennium and is prorated over the two-year permit period.

PERMIT MONTH

JUNE

JULY

AUG.

SEPT.

OCT.

NOV.

DEC.

JAN.

FEB.

MAR.*

APR.*

MAY*

1st Year Fee

$180.00 $172.50 $165.00 $157.50 $150.00 $142.50 $135.00 $127.50 $120.00 $112.50

$105.00

$97.50

2nd Year Fee

90.00

82.50

75.00

67.50

60.00

52.50

45.00

37.50

30.00

22.50

15.00

7.50

Prorated Fee*

202.50*

195.00*

187.50*

FOR ASSISTANCE:

If you have any questions regarding the completion of this form or cigarette, cigar and/or tobacco products tax, you may contact the Texas

State Comptroller’s office at (800) 862-2260 or (512) 463-3731. You can also visit our website at

Legal cites: TEX.TAX CODE ANN. CH. 154 and CH. 155 and 42 U.S.C. sec. 405(c) (2) (C).

1

1 2

2