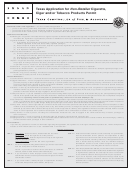

Form 69-121 (Back)(Rev.7-09/4)

INSTRUCTIONS FOR COMPLETING

BUSINESS LOCATION SUPPLEMENT FOR

CIGARETTE AND/OR TOBACCO PRODUCTS PERMIT

Under Ch. 559, Government Code, you are entitled to review, request and correct information we have on file about you, with limited exceptions in accordance with Ch. 552,

Government Code. To request information for review or to request error correction, contact us at the address or phone numbers listed on this form.

WHO MUST SUBMIT THIS SUPPLEMENT -

You must submit this supplement if:

• you currently have an active retailer or non-retailer cigarette and/or tobacco products permit; AND

• you have acquired a NEW business location where cigarette and/or tobacco products business will take place; including delivery sales of

cigarettes through the Internet or mail order.

GENERAL DEFINITIONS

Business Location Address (Item 4) - Please provide the physical commercial business location address where cigarettes, cigars and/or tobacco

products are sold; kept for sale or consumption, or are otherwise stored. (Use street address and number or directions, city, state, and ZIP Code - NOT

a P.O. Box or rural route and box number.)

Commercial Business Location (Item 6) - means the entire premises that your business occupies. In addition, the business location where your

cigarettes and/or tobacco products are stored or kept cannot be a residence or a unit in a public storage facility (Except for cigars and tobacco products

Manufacturer's Representatives).

Customs Bonded Warehouse (Item 8) - means a business location under the jurisdiction of the Federal Government.

Delivery Sales (Item 12) - means a sale of cigarettes to a consumer in this state in which the purchaser submits the order for the sale by means

of telephone or other method of voice transmission, by using the mail or any other delivery service, or though the Internet or another on-line

service, or the cigarettes are delivered by use of the mails or another delivery service. A sale of cigarettes is a delivery sale regardless of

whether the seller is located within or outside Texas.

Retailer Permit Period & Fee - The permit period for a Cigarette, Cigar and/or Tobacco Products Retailer Permit is June 1st through May 31st and is

renewed every two years (2000, 2002, 2004, etc.). The permit expires on the last day of May of each even numbered year.

The permit fee for a new business location is due on or before the 30th day after the first business date, to avoid the $50.00 late fee.

Effective Sept. 1, 1999, the retailer permit fee per biennium is $180.00. The retailer permit fee is prorated over a two-year permit period.

RETAILER PERMIT FEE

JUNE

JULY

AUG.

SEPT.

OCT.

NOV.

DEC.

JAN.

FEB.

MAR.*

APR.*

MAY*

EVEN YEAR

$180.00

$172.50

$165.00

$157.50

$150.00

$142.50

$135.00

$127.50

$120.00

$112.50

$105.00

$97.50

ODD YEAR

90.00

82.50

75.00

67.50

60.00

52.50

45.00

37.50

30.00

22.50

15.00

7.50

Prorated Fee - This fee amount includes the amount for the last months of the permit period:

202.50*

195.00*

187.50*

* During the last three months of the permit period, the Comptroller may collect the prorated permit fee for the current period and the fee for the next

permit period. Add the amounts in the "Annual Fee" column to the prorated amount for the applicable month.

Non-Retailer Permit Period & Fee - The permit period for a Cigarette, Cigar and/or Tobacco Products Non-Retailer Permit is March 1st through the

last day of February and is renewed every year. The permit fee for a new business location is due on or before the 30th day after the first business

date, to avoid the $50.00 late fee.

PERMIT TYPE - ANN. FEE

MAR.

APR.

MAY

JUNE

JULY

AUG.

SEPT.

OCT.

NOV.

DEC.*

JAN.*

FEB.*

Bonded agent - $300.00

$300.00

$275.00

$250.00

$225.00

$200.00

$175.00

$150.00

$125.00

$100.00

$75.00

$50.00

$25.00

Distributor - $300.00

300.00

275.00

250.00

225.00

200.00

175.00

150.00

125.00

100.00

75.00

50.00

25.00

Manufacturer - $300.00

300.00

275.00

250.00

225.00

200.00

175.00

150.00

125.00

100.00

75.00

50.00

25.00

Wholesaler - $200.00

200.00

183.33

166.67

150.00

133.33

116.67

100.00

83.33

66.67

50.00

33.33

16.67

Importer

NO FEE

NO FEE

NO FEE

NO FEE

NO FEE

NO FEE

NO FEE

NO FEE

NO FEE

NO FEE

NO FEE

NO FEE

* During the last three months of the permit period, the Comptroller may collect the prorated permit fee for the current period and the fee for the next

permit period. Add the amounts in the "Annual Fee" column to the prorated amount for the applicable month. For example, the January fee for a Bonded

Agent is $50.00 plus the annual fee of $300.00 for a total of $350.00.

YOUR PERMIT MUST BE PROMINENTLY DISPLAYED IN YOUR PLACE OF BUSINESS.

THE INFORMATION ON YOUR PERMIT IS PUBLIC INFORMATION.

Complete this supplement and mail with your payment to:

COMPTROLLER OF PUBLIC ACCOUNTS

111 E. 17th Street

Austin, TX 78774-0100

Make check payable to:

STATE COMPTROLLER

FOR ASSISTANCE

If you have any questions regarding this business location supplement or cigarette, cigar and/or tobacco products tax, you may contact the Texas State

Comptroller's office at (800) 862-2260 or (512) 463-3731. You can also visit our website at

1

1 2

2