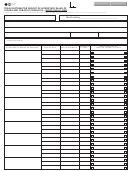

Form 69-136 (Back)(9-09)

INSTRUCTIONS FOR COMPLETING

TEXAS DISTRIBUTOR RECEIVING RECORD OF CIGAR AND TOBACCO PRODUCTS – EFFECTIVE 9/1/2009

Under Ch. 559, Government Code, you are entitled to review, request and correct information we have on file about you, with limited exceptions in accordance with Ch. 552,

Government Code. To request information for review or to request error correction, contact us at the phone numbers listed on this form.

GENERAL INFORMATION

Who Must File: Texas tobacco distributors who receive tax-paid or tax-unpaid tobacco products MUST complete the Texas Distributor Receiving Record of Cigar and Tobacco Products

during the report filing period.

When to File: Mail the receiving record of cigar and tobacco products form(s) along with your Texas Distributor Monthly Report of Cigar and Tobacco Products (Form 69-133) for the

same filing period on or before the due date listed on Form 69-133.

SPECIFIC INSTRUCTIONS

Item a - Taxpayer number - Enter the 11-digit taxpayer number as shown in Item c of Form 69-133.

Item c - Filing period - Enter the report filing period. The filing period should be the same as the filing period shown in Item d of Form 69-133.

Item d - Taxpayer name - Enter the entity/taxpayer name as shown in Item g of Form 69-133.

Item e - Physical address of permitted location - Enter the physical address of your cigar and tobacco products tax permitted location as shown in Item l of Form 69-133. Do not use a

rural route or P.O. Box.

Item f - Beginning inventory - Enter the beginning inventory for each product class. These amounts should be equal to the ending inventory amounts from the prior period’s report. For

Class W, enter the number or weight; for Class B, C, D and F, enter volume.

Item g - Ending inventory - Enter the actual physical inventory on the last day of the month for each product class. These amounts should equal the beginning inventory amounts plus

the total amounts for each product class from al l receiving records minus the Total Monthly Sales submitted for this report period. For Class W, enter the number or weight; for

Class B, C, D and F, enter volume.

Product Class Definitions

Class W - (9-1-09 and after) Tobacco including chewing tobacco, snuff, pipe tobacco, roll-your-own and any other article or product that is made of tobacco or a tobacco substitute

that is not a cigarette.

Class B - Little cigars with a weight of not more than 3 pounds per thousand.

Class C - Cigars weighing more than 3 pounds per thousand selling for 3.3 cents or less each.

Class D - Cigars weighing more than 3 pounds per thousand of natural leaf selling for over 3.3 cents each. NOTE: Attach an affidavit from the manufacturer, importer or

supplier stating that the cigars do not contain sheet wrapper, sheet binder or sheet filler.

Class F - Cigars weighing more than 3 pounds per thousand of substantial non-tobacco filler selling for over 3.3 cents each.

Item 1 - Received date - Enter the date that identifies the receipt of cigar and tobacco products purchased or received from a manufacturer, importer and/or supplier.

Item 2 - Invoice number - Enter the invoice number that identifies the receipt of the cigar and tobacco products purchased or received from a manufacturer, importer and/or supplier.

Item 3 - Name of manufacturer, importer or supplier - Enter the name of the manufacturer, importer or supplier from whom the tax-paid or tax-unpaid cigar and tobacco products were

purchased or received. If you purchase tax-paid inventory from another Texas distributor, you must report that purchase; however, you should not include that dollar amount in

Item g. You may prepare a separate Form 69-136 for the tax-paid purchases.

Item 4 - Class W - Enter either the total of all individual cans or packages (ea.) weighing less than or equal to 1.2 ounces and the total weight in ounces (oz.) for all individual cans or

packages weighing more than 1.2 ounces.

Items 5 - 8 - Class B, C, D and F - Enter the volume for each class product. Refer to the product class definitions identified above.

Item h - Grand totals for this page only - Enter the total amounts for each product class on this page only.

FOR ASSISTANCE

If you have any questions regarding the Texas cigar and tobacco products tax, contact the State Comptroller’s office at (800) 862-2260 or (512) 463-3731. Our Web address

is

1

1 2

2